4 Charts Expose Feds’ Hypocrisy: Cracking Down on Taxpayers While Own Improper Payments Go Unchecked

The Inflation Reduction Act gives the IRS an additional $80 billion to hire 87,000 more agents with the hope of bringing in about $200 billion in additional tax revenues over the next 10 years. But in 2021 alone, the federal government spent $279 billion of taxpayers’ money on improper payments. This glaring double standard—cracking down on taxpayers who have to navigate a 7,000-page tax code as the federal government fails miserably at making the proper payments in the programs it designs and administers itself—shouldn’t exist.

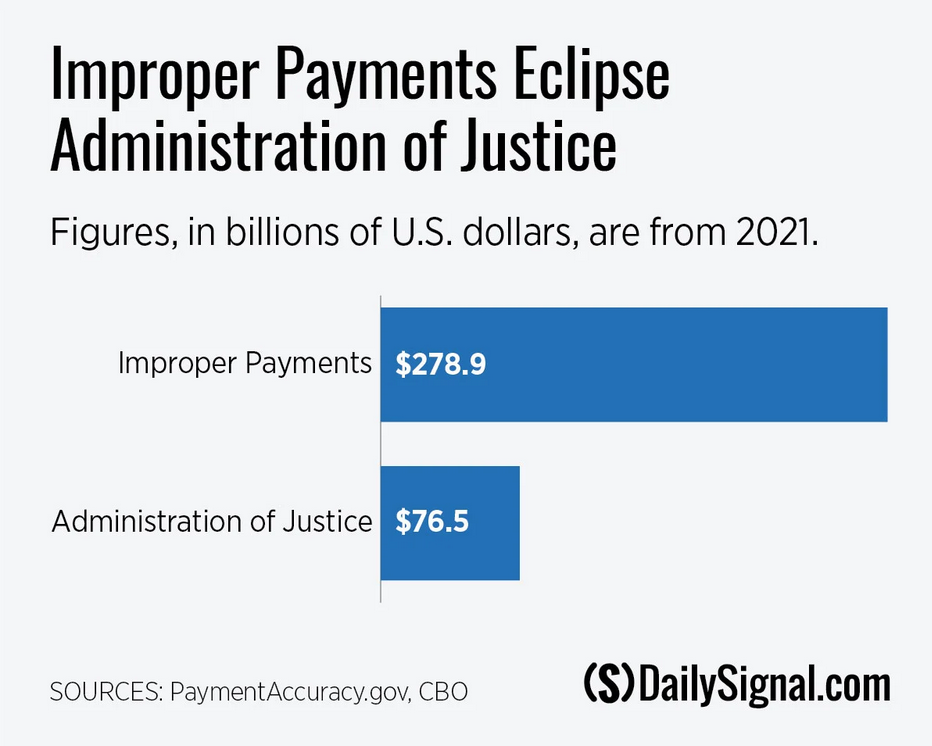

At a cost of more than $2,000 per household, Americans are paying more for bureaucrats to send faulty payments—to the wrong people or in the wrong amounts—than they are for some of the core functions of the federal government.

At a cost of more than $2,000 per household, Americans are paying more for bureaucrats to send faulty payments—to the wrong people or in the wrong amounts—than they are for some of the core functions of the federal government.

Improper payment rates across most of the federal government’s 78 reported programs are high enough to put any private sector company out of business. But a handful of large programs account for the vast majority of improper payments. Nine programs accounted for 94%, or $262 billion, of improper payments in 2021. Health insurance programs and child-related tax credits have the highest rates of improper payments: More than 1 in 5 Medicaid dollars, more than 1 in 4 earned income tax credit dollars, and more than 1 in 3 children’s health insurance program dollars were improper payments.

The program with the worst track record in 2021 was the Department of Veterans Affairs’ long-term services and supports, which properly paid only 27%, or $708 million, out of $2.6 billion in total payments.

More From Daily Signal