Playing Favorites with the Tax Code

< < Go Back

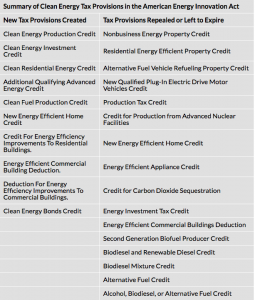

Earlier this week, Democrats on the Senate Committee on Energy and Natural Resources released the American Energy Innovation Act, a 437-page bill aimed at promoting clean energy and improving the country’s energy infrastructure. About 100 pages of the bill are devoted to rewriting several sections of the tax code that deal with energy.

– The bill would simplify the treatment of energy in the tax code.

– The new clean energy credits are technology-neutral.

– The bill uses performance-based standards to compute tax credits.

– The bill implicitly sets a price on carbon emissions mitigation.

– The bill would continue to subsidize the production of energy.

– The bill would discourage investment and jobs in the oil and gas industries.

Under an ideal tax code, businesses would be able to deduct all investment expenses as they occur. In practice, the federal tax code has dozens of depreciation schedules for different investments, which require businesses to deduct the costs over several years. The longer businesses are required to deduct the costs of investment, the more harmful for growth and investment. The Senate Democrats’ bill would force oil and gas companies to spread out the costs of drilling over a longer period of time, harming investment and moving further away from an ideal treatment of capital expenses.

If the government wants to encourage clean energy through the tax code, clean energy companies should be allowed to fully expense their capital investments. Full expensing would prevent companies from being taxed on income that does not yet exist and would encourage investment and growth.

More From NCPA: