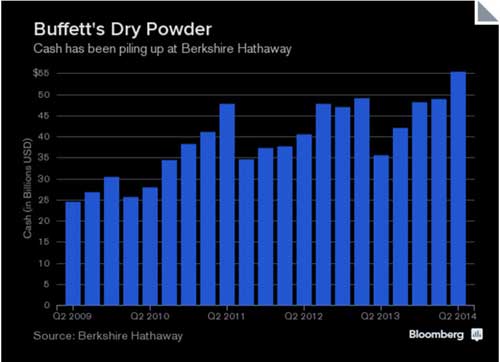

“Uncle Warren” Sitting on Record $55B Cash! If He’s Not Buying, Should YOU?

< < Go Back

Good ole’ “Uncle Warren.” The Cherry Coke-swilling, cheeseburger-eating founder of Berkshire Hathaway is a legend in the investing world.

Indeed, Warren Buffett’s down-home, folksy wisdom and long-term record of investment success have earned him legions of followers. The mere mention or rumor of an investment from Buffett is enough to send stock prices soaring, even if his “buy and hold” approach periodically goes out of favor.

So what is Buffett investing in now? Cash!

It’s true! Bloomberg News reported this morning that Berkshire’s cash hoard just topped the $55 billion mark in June.

How surprising is that?

First, Buffett has never had that much cash sitting idle at the end of a quarter in his more than four decades at the firm’s helm.

Second, cash on hand has surged more than 55 percent in the past year.

Third, the overall level is more than double the cushion Buffett says he likes to keep lying around in case of unexpected losses tied to Berkshire’s large insurance businesses.

So what should we make of this trend? Well, if you’re an optimist, you could say Buffett is probably getting ready to launch another big round of mega-buyouts. He shelled out several billion dollars to buy up the Burlington Northern Santa Fe railroad in 2010 … several billion dollars more to buy a large stake in IBM back in 2011 … and several billion dollars more to help privatize HJ Heinz in 2013.

But if you’re more of a pessimist, you could raise an obvious question: “If Warren Buffett isn’t out there aggressively buying stocks, why the heck should I do so?” It’s not just Buffett who’s husbanding cash rather than aggressively deploying it, either. Private equity firms are sitting on their own $1.16 trillion cash hoard — the most ever, per Bloomberg.

More From Money & Markets: