Job Growth Gathers Strength

< < Go Back

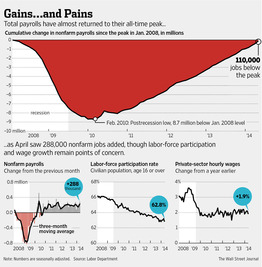

April Sees 288,000 Jump; Earlier Estimates Raised; Participation Rate, Wages a Worry.

U.S. employers in April added jobs at one of the fastest paces of the recovery, rekindling hopes for an upturn strong enough to alleviate the economy’s longstanding ills.

Nonfarm employment grew by 288,000 in April and the jobless rate sank to 6.3%, the Labor Department said Friday. The new jobs—spread across an array of industries from retail to construction—put total payrolls closer to the all-time peak, reached near the recession’s start, after a long and grinding recovery.

The report offered a sense of relief just days after the government said the U.S. economy nearly stalled in the first quarter, expanding at an annual pace of just 0.1%. It also helps put to rest doubts about the durability of the recovery more broadly, coming after harsh winter weather slowed job growth and other economic indicators.

“The economy was frozen at the beginning of the year and it has thawed out,” said Stuart Hoffman, chief economist at PNC Financial Services Group. The latest job growth suggests the weak reading of economic output was “a big head fake and the economy has picked up a lot of momentum.”

Still, the report included numerous worrisome signs, among them another exodus of workers from the labor force and persistently weak wages.

The burst of job growth is still likely enough to reassure Federal Reserve officials as they gradually withdraw the central bank’s support for the economy. Fed policy makers this past week further cut their monthly bond purchases, launched in 2012 to help goose the recovery, by $10 billion to $45 billion based on their assessment the economy is strengthening. But Fed officials remain concerned about the broader slack in the long-struggling labor market, including factors highlighted in Friday’s data, that should keep them wary of raising interest rates soon.

More From The Wall Street Journal (subscription required):