The United Kingdom’s Experience with Lower Corporate Tax Rates

< < Go Back

The U.S. corporate income tax should be reduced without lengthening asset lives, says Kyle Pomerleau, an economist at the Tax Foundation.

Currently, the corporate income tax rate sits at 39.1 percent. Proposals have emerged to reduce that rate. However, in exchange for such a reduction, some of these proposals have advocated for a change in asset depreciation schedules by lengthening the life of assets. Such proposals would offset the impact of a reduction in the corporate rate.

When businesses purchase assets, depreciation schedules determine how these capital investments are treated for taxation purposes, with the schedules identifying how much of those assets can be deducted from a business’ taxable income each year. By lengthening these asset lives, corporate taxable income would increase, as businesses would not be able to deduct as much from their taxable income.

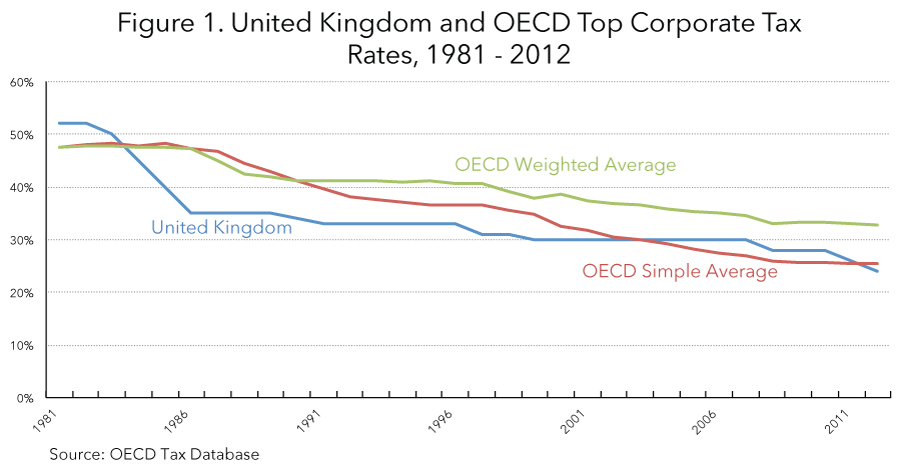

The United States should look to the United Kingdom’s experience with lengthening asset lives. The United Kingdom has actually lowered its corporate tax rate by more than 25 percentage points over the last three decades, down from 52 percent in 1979 to 24 percent in 2012. But because it also lengthened its depreciation schedules, the nation did not reap the benefits that it expected from the lower rate.

– In the 1980s, the United Kingdom allowed a corporation to write off 95 percent of its capital investments. In 2008, that figure dropped to 47 percent of an asset’s cost.

– The effective marginal tax rate on corporate investment has actually increased, despite the corporate tax rate decline, thanks to these depreciation schedule changes.

Lowering the income tax rate should boost investment, but the United Kingdom has not seen that boost, and in fact it had the lowest level of investment as a percentage of gross domestic product among all Organization for Economic Cooperation and Development nations in 2012.

More From FoxNews: