U.S. States $5 Trillion in Debt

< < Go Back

State governments are facing a total of $5.1 trillion in debt, says State Budget Solutions.

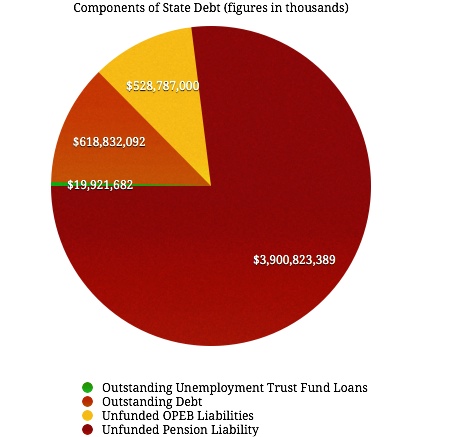

State Budget Solutions has been studying the debt problems of the 50 states since 2010. By combining unfunded pension liabilities, outstanding government debt, unfunded other employment benefit liabilities (retiree health benefits) and outstanding unemployment trust fund loans, researchers determined total state debt figures.

– States’ combined $5.1 trillion debt is the equivalent of $16,178 per capita or 33 percent of yearly gross state product.

– Unfunded public pension liabilities constitute a whopping 79 percent of all state debt — over $3.9 trillion.

– California, New York and Texas topped the state debt list, with total debts of $778 billion, $388 billion and $341 billion, respectively. The report pointed out that the top five indebted states were also those with some of the largest populations. The least indebted state? South Dakota, at $7.7 billion.

– On a per capita basis, Alaska held the highest state debt, at $40,714 per person. Right behind were Hawaii, Connecticut, Ohio and Illinois.

Comparing these debt figures with a state’s expenditures gives an indication of how these debts could strain state budgets.

– In 2012, Nevada’s debt was 1,048 percent of its state spending. Rounding out the top five were Ohio (with a debt level at 742 percent of its spending), Illinois (727 percent), California (647 percent) and Georgia (633 percent).

– The five states with the lowest debt as a percentage of spending were West Virginia (141 percent), Wisconsin (146 percent), Nebraska (191 percent), Wyoming (222 percent) and North Dakota (224 percent).

More From NCPA: