U.S. Economy Shows Signs of Gearing Up

< < Go Back

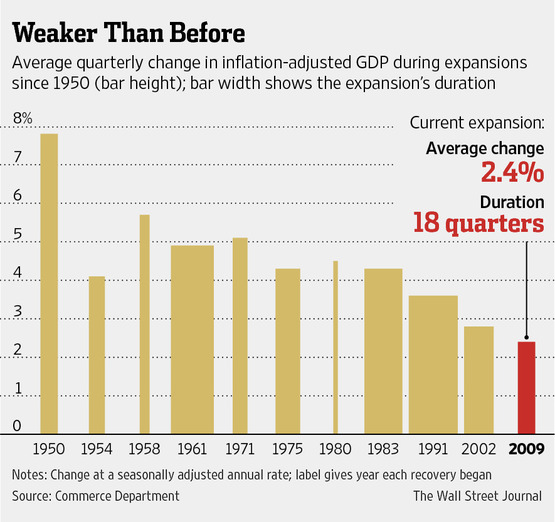

Consumers, Businesses Spend More Freely, but Recovery Remains Historically Weak.

A potent mix of rising exports, consumer spending and business investment helped the U.S. economy end the year on solid footing.

Gross domestic product, the broadest measure of goods and services churned out by the economy, grew at a seasonally adjusted annual rate of 3.2% in the fourth quarter, the Commerce Department said. That was less than the third quarter’s 4.1% pace, but overall the final six months of the year delivered the strongest second half since 2003, when the economy was thriving.

There has been a pattern of the economy perking up for a time only to stumble again amid a new crisis, and that could happen again. One potential risk: the reverberations from a currency crisis in emerging markets. Disappointing numbers on jobs and housing also have raised concerns about whether the economy is accelerating. More than four years after the end of the recession, America’s rebound remains weak compared with past recoveries.

But many economists see the U.S. economy moving into a higher gear. Federal Reserve officials, in further pulling back on a bond-buying program meant to spur growth, noted this week that the economy has shown “growing underlying strength.” Consumer confidence is rising, and manufacturers are getting busier to meet increased demand.

A big driver of growth in the fourth quarter was a rise in consumer spending, which grew 3.3%, the fastest pace in three years. Consumer spending accounts for roughly two-thirds of economic activity.

The report wasn’t all good news. Investment in real estate tumbled last quarter for the first time in three years, likely due to unusually cold weather and rising mortgage rates. And some of the nation’s growth came from businesses stockpiling more inventory in anticipation of future demand—a trend that could reverse in coming quarters, economists say.

Additionally, mounting turmoil in emerging economies could weigh on growth overseas and hit U.S. exporters. The slide in international markets over the past week could become a hurdle if it weighs on investors and businesses and drags down Americans’ investment portfolios. That, in turn, might leave less room for consumers’ discretionary purchases.

Despite the expansion in consumer spending, it remains too slow for firms to raise their prices. A key gauge of inflation, the price index for personal consumption expenditures, rose at an annualized 0.7% during the quarter. That was well below the Federal Reserve’s annual 2% target

More From The Wall Street Journal (subscription required):