Bitcoin Dreams

< < Go Back

Why are investors so crazy for an alternative currency invented by a phantom?

Bitcoin is the digital currency that thrills nerds, inspires libertarians, and incites the passions of economists who debate the value of money made from nothing but ones and zeroes. Devotees watch the fluctuations of Bitcoin’s price with a fanaticism typically reserved for college football scores. Alternative currency startups are being lavishly funded by venture capitalists while visionaries gush about the world-changing possibilities of money free from government control. Silicon Valley is the natural center for Bitcoin mania. An advocacy group named Arisebitcoin recently put up 40 billboards around the Bay Area with messages such as: “The Revolution has started … where do you stand?”

As with an actual precious metal, Bitcoins are in limited supply—they must be “mined.” Unlike with precious metals, this mining is done purely by computer. Miners set their machines to run a series of complex calculations that tally up and certify all the transactions of other Bitcoin holders around the world. If the miner’s computers complete these calculations and solve a complex mathematical puzzle before anyone else, he earns about 25 Bitcoins as payment. It’s a nice haul: With the price of each Bitcoin nosing up near $1,000, that’s $25,000 for 10 minutes or so of work. For the moment at least, miners are the rare grunts who can also get rich.

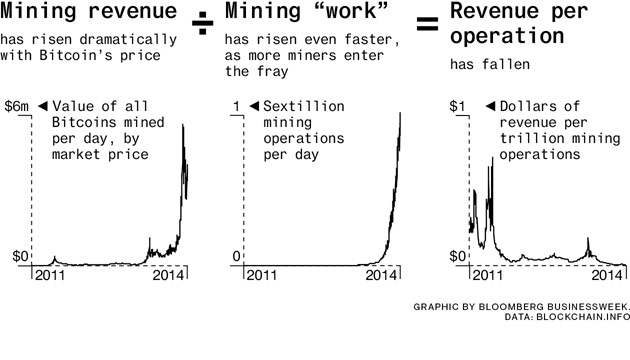

Over the past six months the price of a Bitcoin has shot up, dived, shot up again—and kept on rising, making Bitcoin mining one of the most frenzied corners in technology.

The Bitcoin system was introduced in 2008 by a shadowy figure who went by the name of Satoshi Nakamoto. To this day no one knows if Nakamoto is a man or a woman or some sort of cabal, though few deny the ingenuity of the creation. Digital currencies had been devised before—DigiCash and Bit Gold, for example—and never took off. Nakamoto started with the best ideas behind these earlier currencies, added a few of his own, and wove it all together with technical elegance. The biggest achievement was solving a long-standing problem of borderless digital money: With no government oversight or central database to track transactions, how do you prevent fraud?

Nakamoto’s solution has two important parts. The first is a public ledger, shared across the Internet, which is a way to validate all Bitcoin transactions and eliminate counterfeiting. Every time someone makes a purchase or exchanges Bitcoin for another currency, that transaction is broadcast to anyone running open-source Bitcoin software. Some users run a highly specialized version of the software, which brings us to the second part of Nakamoto’s solution: mining. Bitcoin miners are, in a sense, both maintainers of the public ledger and expanders of the virtual money supply. One more twist: The Bitcoin system makes sure the money supply expands gradually. The maximum number of minable Bitcoins worldwide is currently 25 every 10 minutes. It’s like a worldwide math competition that resets six times an hour. There are a total of 21 million possible Bitcoins; about half are currently in circulation. The last will be mined in about 2140 at the earliest.

… secretive … new mining companies such as Bitfury, HashFast Technologies, CoinTerra and Silicon Valley-based 21e6. Supermine projects like 21e6 wrap up all the promise and danger of the libertarian sensibility that underlies Bitcoin. For HashFast and other miners, trying to corner the market in the world’s most successful virtual currency is a Dr. Evil-patting-the-cat move.

Even some Bitcoin entrepreneurs think mining has become a sucker’s game. Fred Ehrsam is a former Goldman Sachs (GS) trader and co-founder of Coinbase, a Bitcoin startup making wallet software that allows people to trade and store Bitcoins. “This is very much a fad that is going to die soon, if it’s not even dead already,” he says.

“Mining was supposed to be a democratized thing, but it’s now only accessible to the elite of the elites,” says Chris Larsen, CEO of Ripple Labs, which has introduced a virtual currency called Ripple. It’s similar to Bitcoin but without the mining.

Joel Flickinger’s also tired of the scammers, and there are a lot of those. He recently paid one huckster on Craigslist $14,000 for two rigs that never arrived and now keeps an eye out for similar cons. “If I see anyone doing this kind of thing, I will warn people,” he says. “I’ve been doing my part.” He’s still mining, though, doing his daily server ministrations, redlining his chips above 73.5C, and writing himself inspirational Post-its. “I don’t fully understand how Bitcoin works,” he says. “But then, I don’t get Miley Cyrus either.”

More From Bloomberg Businessweek: