Fed to Start Unwinding Its Stimulus Next Month

< < Go Back

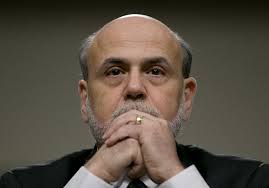

The Federal Reserve said on Wednesday that it would gradually end its bond-buying program during 2014, a modest first step toward unwinding the central bank’s broader stimulus campaign as its officials gain confidence that the economy is growing steadily.

The Federal Reserve said on Wednesday that it would gradually end its bond-buying program during 2014, a modest first step toward unwinding the central bank’s broader stimulus campaign as its officials gain confidence that the economy is growing steadily.

The Fed plans to cut its monthly purchases of Treasury and mortgage-backed securities from $85 billion in December to nothing by the end of next year in a series of small steps, starting with a reduction to $75 billion in January, the central bank announced after a two-day meeting of its policy-making committee.

At the same time, the Fed sought to offset concerns that it was once again pulling back too soon by strengthening its plans to hold short-term interest rates near zero, which officials regard as a more powerful means of stimulating growth. Both policies aim to hold down borrowing costs and revive risk-taking.

Investors appeared to agree with Mr. Bernanke, defying predictions that stock prices would retreat along with the Fed’s pullback. Major stock indexes spiked when the Fed’s statement was released at 2 p.m., and the Standard & Poor’s 500-stock index rose 1.7 percent by the end of the trading day. Importantly, interest rates on benchmark bonds — the rates the Fed is trying to influence — ended the day roughly where they started.

One reason for investor enthusiasm, said Michael Hanson, senior economist at Bank of America Merrill Lynch, is the stimulus will be withdrawn very gradually.

A variety of indicators suggest the American economy may now be growing more quickly than analysts predicted, and Fed officials anticipate somewhat faster growth in the coming year. But the persistence of low inflation indicates the economy is operating well below its capacity.

More From The New York Times: