Trump’s Blue State Revival Plan

< < Go Back

Schumer’s choice: Play on tax reform or lose the state and local deduction.

Chuck Schumer aspires to raise taxes on every rich person in America, save one protected class: coastal progressives. The Senate Minority Leader recently styled part of President Trump’s tax plan as “a dagger aimed at the heart” of New Yorkers. Like many other Democrats, he’s apoplectic about a plan to end the state and local tax deduction.

Taxpayers who itemize—about one in three do so—can deduct income and property taxes paid to state and local governments from their federal tax liability. The White House in its recent tax outline proposes eliminating the deduction, and the House blueprint does as well.

One goal of tax reform is to reduce unproductive tax loopholes, and ending the state and local deduction would generate revenue to finance lower rates: The deduction is worth about $100 billion a year—the sixth largest individual income tax break. The Tax Foundation estimates that eliminating the write-off would raise $1.8 trillion in revenue over a decade.

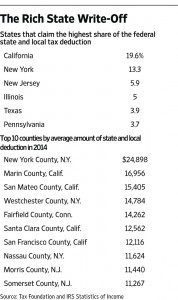

While Democrats like to soak the affluent, they make an exception for the state and local deduction: About 88% of the benefits in 2014 flowed to taxpayers who earn more than $100,000, while 1% went to those who earn less than $50,000. California alone reaps nearly 20% of the benefit, according to the Tax Foundation, and a mere six states get more than half.

Eliminating the deduction would be a powerful incentive for Governors to cut state taxes on residents who are suddenly exposed to their full liability. This is not a punishment for progressive locales but a revival project for Democratic states. Tens of thousands of Northeasterners have fled to Florida, and Connecticut Governor Dannel Malloy is all but personally negotiating with residents on what subsidies, loan forgiveness or other handouts will keep them from leaving his state.

Eventually that tax-base erosion will sink public pensions and other unfunded liabilities. Removing the deduction would force Mr. Malloy and his counterparts either to cut taxes or watch the notices to vacate continue. At a minimum, killing the subsidy would increase the political cost of blithely raising taxes.

The political resistance to killing the state and local deduction will be fierce, and even Ronald Reagan in 1986 could not muscle a plan through Congress that eliminated it.

the Schumer Democrats have no standing to stop Republicans from eliminating the blue state tax benefit if they sit out the debate. The GOP only has an incentive to deal if Mr. Schumer delivers at least eight Democrats to provide the 60 votes to make tax reform permanent under Senate budget rules. What will it be, Chuck, play or have your constituents pay?

More From The Wall Street Journal (subscription required):