Localities Opt for Less Debt Over New Infrastructure

< < Go Back

Plunging global interest rates have made borrowing cheap, but many are struggling with sluggish revenue growth and higher expenses.

Wall Street is urging governments to invest in big-ticket infrastructure projects. Voters and public officials have a different message: not so fast.

Plunging global interest rates have made borrowing cheaper than ever. But instead of spending on aging roads, bridges and buildings, many state and local governments are scaling back.

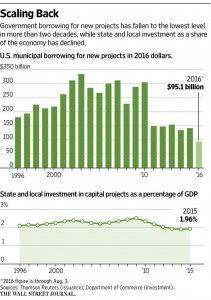

New government-bond issues have dropped to levels not seen in the past 20 years. Municipal borrowers issued about $140 billion in bonds for new projects last year. Adjusted for inflation, that is 53% lower than in 2006 and 21% lower than in 1996. So far this year, municipalities have borrowed $95.1 billion, about $10 billion more than at this time last year.

Seven years after the recession ended, voters and government officials remain scarred by the deep budget cuts they endured at the height of the financial crisis and the sluggish revenue growth that has constrained spending since then.

“The collapse in interest rates corresponded with the recession and with a political trend toward antitax sentiment,” said Dan Seymour, an analyst with Moody’s Investors Service. ”Even as state and local governments are looking at lower bond yields, they are facing a public that is reluctant to pay more taxes.”

As a share of the economy, state and local governments are investing less in capital projects than they have since the early 1980s, according to Commerce Department data.

More From The Wall Street Journal (subscription required):