Chinese Cash Floods U.S. Real Estate Market

< < Go Back

This year, Chinese families represented for the first time the largest group of overseas home buyers in the United States.

Canyon Lake Ranch was once a playground for Christian day campers, and then was a corporate retreat with water-skiing, barbecues and cowboy shoot-’em-up shows. Hawks now circle above 108 sunbaked acres occupied by copperhead snakes, a few coyotes and the occasional construction truck.

Soon this ranch will be a gated subdivision of 99 mini-mansions designed for buyers from mainland China. The developer, Zhang Long, a Beijing businessman, is keeping three plots to build his own estate along the site of an old rodeo arena.

This luxury development 35 miles northwest of Dallas is the latest frontier in a global buying phenomenon as Chinese money becomes a major force in real estate around the world. The flood of money is likely to persist despite the current tumult in China. While a currency devaluation and stock market crash have crimped the country’s buying power overseas, the resulting uncertainty is making many Chinese individuals and companies eager to invest anywhere except their home country.

In London, Chinese investors are purchasing high-end apartments in wealthy neighborhoods and big skyscrapers in the financial district. In Canada, they are paying $1 million for modest Vancouver bungalows. In Australia, a Chinese sovereign wealth fund bought nine office towers, one of the biggest real estate transactions in that nation’s history.

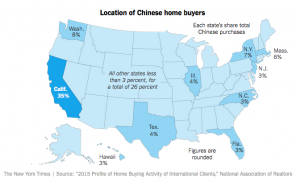

In the United States, the home-buying spree began on the coasts, where Chinese buyers snapped up luxury condos in Manhattan and McMansions in Silicon Valley, pushing up home values in big cities. It is now spreading to the middle of the country, where prices are more modest and have room to run.

The great property rush is part of the tidal wave of Chinese money that is pouring into the global economy and reshaping financial markets. In residential and commercial real estate, the new flow of cash is upending the traditional dynamics of buying and selling.

This year, Chinese families represented for the first time the largest group of overseas home buyers in the United States.

More From The New York Times: