Congress Should Avoid Revenue Neutral Corporate Tax Reform

< < Go Back

The United States’ uncompetitive corporate tax code levies a high marginal tax rate of 39.1 percent (combined federal and state) on corporate income, which is now the highest corporate income tax rate in the world. This has made it more difficult for U.S. businesses to compete both internationally and domestically.

Many policymakers, however, want to accompany lower corporate tax rates with other changes that would increase business taxes in order to maintain revenue neutrality. This type of tax reform gets around difficult issues surrounding how to reform the individual tax code. However, corporate-only tax reform comes with other challenges.

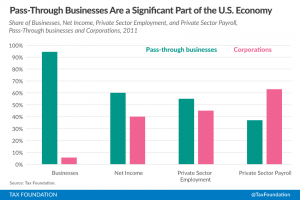

– The corporate-only tax reform leaves a significant amount of businesses out of tax reform. Currently in the United States, 95 percent of all businesses are pass-through businesses. These businesses do not pay taxes through the corporate income tax code; instead, they pay through the individual income tax code. As a result, they would not see any benefit from a corporate rate reduction.

– Revenue neutral corporate tax reform could actually increase taxes on pass-through businesses. In order to pay for a lower corporate tax rate, corporate reform may eliminate business tax expenditures widely used by all businesses, while maintaining current tax rates on pass-through businesses.

These sole proprietorships, S-corporations, and partnerships make up about 95 percent of all businesses. Sole proprietorships comprise the majority. According to Census data, 73.1 percent of all businesses were sole proprietorships (20.3 million firms), 13.1 percent of all businesses were S corporations (3.65 million firms), and about 8 percent were partnerships (2.2 million firms) in 2011. C-corporations only made up 5.6 percent of all businesses in the United States (1.5 million firms).

More From NCPA: