A backdoor tax hike

< < Go Back

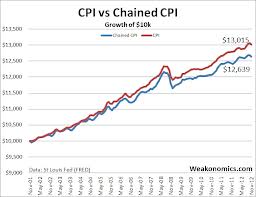

You have probably heard of the chained CPI. It’s anew way of calculation the cost -of-living adjustments to Social Security and veterans benefits and President Obama included in his latest budget proposal.

You have probably heard of the chained CPI. It’s anew way of calculation the cost -of-living adjustments to Social Security and veterans benefits and President Obama included in his latest budget proposal.

Most of the attention has been on the stinger annual increases in benefits associated with the chained-CPI, but it could also increase your income taxes.

How? Because the Chained-CPI would yield smaller increases than the current formula, more of your income would be taxed at a higher rate.

“This impacts a lot of middle class families”, says AARP director Cristina Martin Firvida. Taxpayers with income of $10,000 – $20,000 would see their taxes rise the most-by almost 7%.

So in addition to cutting Social Security benefits by $127 billion over 10 years, the chained CPI would raise income taxes by $142 billion.

Read More: