Will the BAT Be the Tax That Changes Everything?

< < Go Back

by Haley Sweetland Edwards,

There are lots of reasons for California Representative Devin Nunes to be excited about his job these days. As chairman of the House Intelligence Committee, he is leading a classified investigation into Russian interference in U.S. elections, and as a member of President Trump’s transition team, he played a key role in staffing the new Administration. But if you talk to the 43-year-old Congressman, it soon becomes clear that nothing gets him going quite like a wonky hunk of tax policy that means nothing to most Americans: the destination-based cash-flow tax with border adjustment–or BAT, for short.

“It changes absolutely everything,” Nunes told TIME recently, from his ground-floor office across the street from Capitol Hill. “It moves us to a fundamentally new system.”

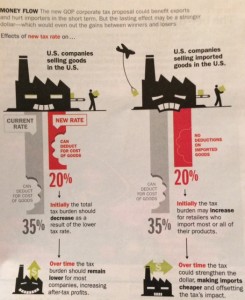

Nunes is one of the most vocal champions of the central, mind-bending provision of the House Republican plan to overhaul the corporate tax code. It would lower the corporate tax rate to 20%, from 35%, eliminate levies on all U.S. exports and impose a 20% tax on imports. It’s a mix that is expected to raise an estimated $1 trillion in federal revenue over a decade, according to the Tax Foundation, making it the linchpin for passing any comprehensive tax-reform bill this term. “It’s a really, really big deal,” Nunes says of the proposal that House Republicans hope Trump will formally embrace in the coming weeks.

But the tax has also earned really, really big enemies, igniting something of a conservative civil war in Washington, with House Republican leadership lining up in favor and deep-pocketed activists and lobbyists vehemently opposed. The BAT, opponents say, would force big-box stores out of business, drive up the cost of everything from baby formula to avocados and potentially spark a devastating trade war. “I think we need to be realistic about what a huge risk this is for our economy,” says David French, the top lobbyist for the National Retail Federation.

More From TIME Magazine: