Does Health Insurance Encourage or Crowd Out Beneficial Nonmedical Care?

< < Go Back

Diabetics can experience serious or fatal complications without regular monitoring (of blood glucose and other indicators of disease severity) and, in some cases, prescription medication. These activities can present a significant financial burden that could be substantially attenuated by health insurance.

Betty Fout and Donna Gilleskie of the Massachusetts Institute of Technology analyze the decisions of individuals with diabetes to monitor, treat and manage their condition and their subsequent health outcomes. They found:

– Use of oral medications falls as cost-sharing of prescription drugs increases.

– Exercise to manage diabetes is slightly more likely when uninsured.

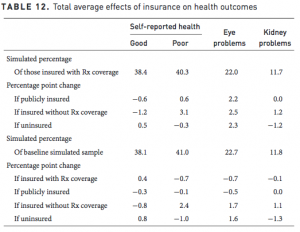

– The insurance simulations show that the probabilities of eye and kidney problems decrease with more generous insurance by as much as 2 and 1 percentage points.

– There is evidence indicating that individuals with public insurance, insurance without drug coverage, and no insurance are more likely to not adhere to health guidelines.

These results suggest three things:

– More generous health insurance does generally help improve the chance that a diabetic adheres to the suggested lifestyle guidelines.

– In most respects public and private health insurance seem to help diabetics adhere to health guidelines. However in some areas, like eye care check-ups, public insurance does not help as much.

– There is evidence that insurance of any kind presents a moral-hazard for diabetics. Insured diabetics are slightly less likely to exercise than those that are uninsured.

More From NCPA: