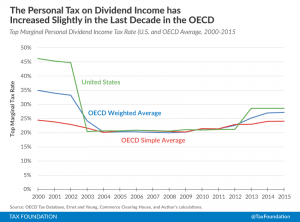

The Tax Burden on Personal Dividend Income In 2015

< < Go Back

U.S. taxpayers face the 9th highest top marginal tax rate on dividend income across the 34 countries of the Organization for Economic Cooperation and Development (OECD).

Dividends are payments made by a corporation to an individual who owns stock in that corporation. Corporations distribute these dividends to investors from their after-tax profits. Once these shareholders receive this dividend income, they must pay personal income taxes on it.

The U.S. personal dividend tax is a double tax on corporate profits and leads to less investment, lower wages, and lower living standards for all. High taxation on corporate profits through high dividend taxes creates a bias against saving and investment. Thus, people will prefer present consumption over saving, resulting in lower levels of investment and less capital in the future.

Taxpayers in the United States currently face a high tax burden on personal dividend income:

– The average combined federal, state, and local top marginal tax rate on dividends in the United States is 28.6 percent — 9th highest in the OECD.

– Taxpayers in California face the highest dividend income tax rate in the United States at 33 percent.

– The U.S. average top marginal tax rate on dividend income of 28.6 percent is 4.5 percentage points higher than the simple average across industrialized nations of 24 percent and 1.5 percentage points higher than the weighted average.

– The taxation of dividend income creates a double tax on corporate income, increases the cost of capital, and reduces investment in the economy.

The combined burden of federal, state, and local taxes on dividend income creates marginal rates that exceed the dividend tax rates of most of the United States\’ major trading partners. Reducing this tax burden on savings and investment will lead to higher wages and better living standards for all.

More From NCPA: