Do Not Underestimate the Implications of a Greek Default

< < Go Back

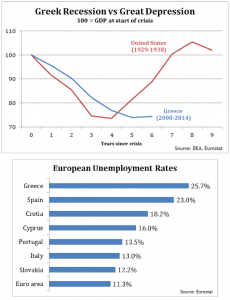

Recent economic and political developments in Greece suggest that it is only matter of time before that country both defaults on its large public debt and imposes capital controls. Those developments could very well pave the way for Greece’s exit from the Euro within the next twelve months. Were that to occur, one must expect that Greece’s economic and political crisis will deepen, which could lead to that country becoming a failed state.

The implications of a Greek default for the United States are not to be underestimated. Over time, a Greek exit could impose considerable economic and geopolitical costs on the United States:

– A strong dollar appreciation could constitute a significant headwind to the U.S. economic recovery and could exert significant downward pressure on U.S. headline inflation.

– Any eventual spread of the Eurozone debt crisis to other countries in the European periphery, like Italy, Portugal, and Spain, could roil global financial markets and dent European household and investor confidence. This would be bound to impact the US economic recovery considering how integrated is the global financial system and how important the European economy is to U.S. trade.

– Should a Greek exit lead both to a souring of European Greek relations and to the further erosion of Greek political stability, one could see a failed Greek state increasingly coming into the Russian orbit. Already the Syriza government is actively engaged with Moscow about the construction of a Russian gas-pipeline through Greece despite the U.S. Administration’s objections.

More From NCPA: