Real, Simple (and Transparent) Tax Reform

< < Go Back

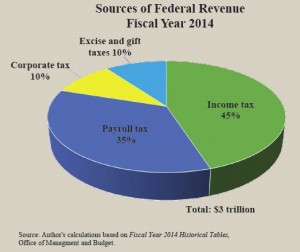

The crux of the U.S. tax problem is that the system is built upon “net income” — income after deductions, exclusions, limitations, credits, rate differentials and so forth — which does not achieve fairness, simplicity or transparency. The tax system today brings in approximately $3 trillion in tax revenue annually.

The share of revenues from each component of the tax system varies from year to year, but on average:

– The biggest share of revenue, $1.4 trillion (about 45 percent), comes from individual income taxes.

– Another $1 trillion (about 35 percent), comes from payroll taxes that fund Social Security and Medicare.

– In a distant third place is the corporate income tax, which brings in $300 billion, or about 10 percent.

– The remaining 10 percent of tax revenue, another $300 billion, comes from a variety of sources: estate and gift taxes, excise taxes on fuel, alcohol, tobacco, firearms, air transportation and so on.

The complex current Internal Revenue Code along with Treasury Regulations, IRS Revenue Rulings, official opinions and judicial decisions comes at a huge cost – billions and billions of hours and dollars in compliance costs for individuals and businesses.

The solution is to replace the existing system with two very simple, broad-based taxes – one for individuals and another for business.

– For individuals, a 15 percent tax on gross wages — in addition to the already existing payroll tax — deducted from paychecks in the same fashion as the current payroll tax system, but with no wage cap.

– No tax on interest, dividends, capital gains or estates.

– For businesses, a simple 2 percent tax on all gross domestic business receipts.

No individual tax returns need be filed. No complicated corporate tax return to file. No need for the IRS, other than perhaps a skeleton crew. No more lobbyists crowding the halls of Congress.

More From NCPA: