Top 20% of Earners Pay 84% of Income Tax

< < Go Back

By Laura Saunders,

And the bottom 20%? They get paid by Uncle Sam. We compare tax burdens as Tax Day approaches.<p> Who pays what in income taxes? With April 15 just around the corner, filers may be curious about where they fit into the system as a whole.

The individual income tax remains the most important levy in the U.S., providing nearly half of federal revenue. This is unusual: On average, developed nations get only one-third of their revenue from income taxes. Typically they also impose national consumption taxes, such as a value-added tax, that raise as much revenue as their income tax.

The pressure on the U.S. income tax has prompted lawmakers on both sides of the aisle to seriously consider a national consumption tax. But liberals worry that such a levy could unduly burden the poor, while conservatives fear it would be too easy to dial up the rate and collect more revenue.

As a result, experts say, there is little chance of tax overhaul this year.

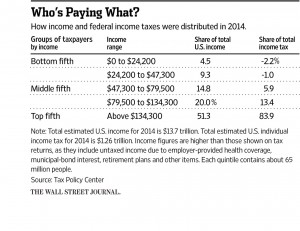

Meanwhile, these two tables offer a snapshot of who is paying what for the 2014 tax year.

The first gives shares of income and federal income taxes for 2014 for some 325 million Americans, dividing the population into five income quintiles of about 65 million people each.

The second table provides further information about the top 20%, who pay more than 80% of income taxes.

More From The Wall Street Journal (subscription required):