Falling Oil Prices Push Venezuela Deeper Into China’s Orbit

< < Go Back

By Peter Wilson,

Venezuelan President Nicolás Maduro had a Plan B in the event the Organization of Petroleum Exporting Countries declined to back his country’s proposal to cut output to boost prices.

The day after OPEC’s Nov. 27 decision to maintain production at current levels, a move that drove oil prices to new lows, a somber-looking Maduro went on national television to tell the Venezuelan people he was dispatching Finance Minister Rodolfo Marco Torres to Beijing. Torres spent the first week of December in China, during which he tweeted photos of his meetings with Chinese officials and bankers.

The late Hugo Chávez cozied up to China as part of his drive to curb U.S. influence in the Americas. Maduro, like his predecessor, has relied on Beijing to underwrite Venezuela’s flagging socialist revolution and finance the country’s gaping fiscal deficits (this year’s shortfall could amount to 15 percent of gross domestic product). Without loans from the Chinese, Maduro’s government might not have been able to weather a deep economic crisis. Under his watch, Venezuelans have had to put up with massive shortages of basic goods, the world’s highest inflation rate, and a steep currency devaluation.

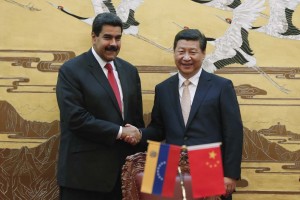

Beijing has so far been happy to oblige Maduro. Since 2007, China has advanced Venezuela about $46 billion in loans repayable in oil, of which about $20 billion has been repaid. The latest loan agreement was in July, when Chinese President Xi Jinping visited the country and pledged $5.69 billion in credits.

Now Maduro needs more. The price of Venezuela’s market basket of crude and petroleum products is now skirting $60 a barrel. Many analysts estimate that the Maduro government needs a price of $120 a barrel to avoid cutting back or postponing spending commitments.

“Maduro would like the Chinese to bail him out,” says Risa Grais-Tarnow, an analyst with the Eurasia Group. “I think the Chinese will have no problems in renewing existing lines of credit. However, they may not be willing to give Venezuela more funds.”

Beijing’s largesse has come at a price. Chinese goods are flooding the Venezuelan market, as many Chinese credits are tied to the import of products and services. The low-priced imports are squeezing local companies.

Chinese cars are now the best-selling models in Venezuela, largely because Ford (F), General Motors (GM), and Toyota (TM) have been forced to shut their assembly lines in Venezuela because they cannot buy dollars to pay for shipments of auto parts.

Home appliances now come largely from China, as do many telephones and computers. Chinese construction companies are building public housing and other infrastructural projects, while the two countries have dozens of joint ventures under study. Venezuela has also had to buy three Chinese communications satellites, although the need is questionable given the country’s other problems.

Not all Venezuelans welcome China’s growing influence. “I don’t know why they are bringing in Chinese construction workers to build apartments for us,” says Geraldo Lopez, a 27-year-old bricklayer in the central industrial city of La Victoria. “We don’t have enough work for ourselves, yet they’re giving these contracts to Chinese companies who don’t employ us.”

Beijing’s imports of Venezuelan oil and petroleum products, mostly fuel oil, have soared in the past eight years. Many analysts suspect that state oil company Petróleos de Venezuela (PDVSA) gives Beijing a discount to cover shipping.

PDVSA receives no money for the oil it sends to China, which has contributed to cash-flow problems. The company had been forced to increase its borrowing to cover costs.

With output falling, PDVSA has had to cut exports to the U.S.—which for decades has been the primary market for Venezuelan crude—so it has enough for the Chinese. In 2006, Venezuela exported an average of 1.42 million barrels of crude and petroleum products daily to the U.S., according to the U.S. Department of Energy. For the first nine months of this year, exports averaged 800,000 bbl/day. And if Maduro makes good on his promise to boost exports to China to 1 million bbl/day in the following years, further reductions in U.S shipments are a given.

China is starting to recognize the danger of becoming overextended to Maduro, whose popularity is in free fall.

“China and Venezuela entered into a special relationship well over a decade ago with one set of assumptions about what each would get, and now, as Venezuela’s crisis deepens, both sides are rethinking the value of what they’ve created,” says Matt Ferchen, who is the resident scholar at the Carnegie–Tsinghua Center for Global Policy, where he runs the China & the Developing World Program.

More From Bloomberg Businessweek: