Entitlements Sinking Federal Budgets in less than 10 years

< < Go Back

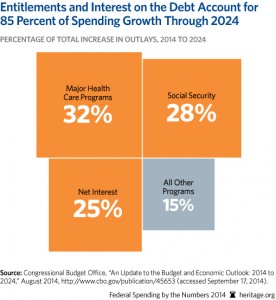

The United States spent $3.5 trillion in 2014, ran a deficit of $486 billion and has a national debt of almost $18 trillion. While the 2014 deficit was lower than in previous years, Romina Boccia, a federal budgetary affairs fellow at the Heritage Foundation, says the drop was largely due to sequestration spending cuts, the expiration of long-term unemployment benefits, an improving economy and tax increases, resulting only in a short-term improvement. By 2024, federal spending is expected to increase by 66 percent, and 85 percent of that projected spending growth is due to increases in entitlement spending.

Where exactly are federal dollars going? According to Boccia, for each dollar of federal spending in 2013:

– Twenty-five percent went to Medicare, Medicaid or other health care programs.

– Twenty-four percent was spent on Social Security, the single largest federal spending program.

– Twenty percent was spent on “income security” benefits, such as federal retirement and disability benefits, unemployment payments and food and housing programs.

– Eighteen percent went toward national defense, while the rest was spent on interest payments, transportation and K-12 education.

To put government spending into perspective, Boccia describes a typical median-income household earning $52,000 in 2014. Had that family structured its finances like the federal government did this year, it would have spent $60,400 in 2014 and put an additional $8,400 on its credit card, adding to an existing credit card debt of $308,000.

More From NCPA: