Raising the Federal Minimum Wage to $10.10 Would Save Safety Net Programs Billions and Help Ensure Businesses Are Doing Their Fair Share

< < Go Back

By David Cooper,

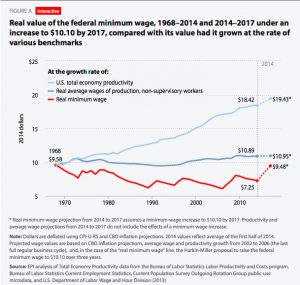

More than five years have passed since the federal minimum wage was raised to its current level of $7.25 per hour. Over that time, the value of a minimum-wage income has fallen nearly 10 percent due to rising prices. Yet this decline is small in comparison to the drop in value of the minimum wage over the past four decades. After rising in line with economy-wide productivity in the three decades following its inception in 1938, the federal minimum wage has been raised so inadequately and so infrequently since the late 1960s that today’s minimum-wage workers make roughly 25 percent less in inflation-adjusted terms than their counterparts 45 years ago. Indeed, a full-time, full-year minimum-wage worker with one child is paid so little that income from her paycheck alone leaves her below the federal poverty line.1

This failure to adequately raise the wage floor has contributed strongly to the stagnation of wage growth at the bottom of the wage distribution. This wage stagnation has, in turn, been the single greatest impediment to making rapid progress in poverty reduction in recent decades. Indeed, all of the decline in poverty reduction in recent decades can be accounted for by safety net and income-support programs.

This issue brief examines the use of public assistance programs by low-wage workers and assesses how raising the federal minimum wage to $10.10 over three years—as proposed by the Fair Minimum Wage Act of 2014, a bill introduced by Sen. Tom Harkin (D-Iowa) and Rep. George Miller (D-Calif.)—could affect utilization rates, benefit amounts, and government spending on these programs.

The key findings are:

– About half of all workers in the bottom 20 percent of wage earners (roughly anyone earning less than $10.10) receive public assistance in the form of Medicaid and the six primary means-tested income-support programs, either directly or through a family member. These programs include the Earned Income Tax Credit (EITC); the Supplemental Nutrition Assistance Program (SNAP), also known as food stamps; the Low Income Home Energy Assistance Program (LIHEAP); the Supplemental Nutrition Program for Women, Infants, and Children (WIC); the Section 8 Housing Choice Voucher program; and the Temporary Assistance for Needy Families program (TANF) or equivalent state and/or local cash assistance programs.

– Workers in the bottom 20 percent of wage earners receive over $45 billion in government assistance each year from the six primary means-tested income-support programs.2

– Roughly half of all public assistance dollars from means-tested income-support programs that go to working individuals go to workers with wages below $10.10.

– If the minimum wage were raised to $10.10, more than 1.7 million American workers would no longer rely on public assistance programs.

– Raising the minimum wage to $10.10 would reduce government expenditures on current income-support programs by $7.6 billion per year—and possibly more, given the conservative nature of this estimate. This would allow these funds to be repurposed into either new programs or expansions of existing programs to further leverage the poverty-fighting impact of this spending.3

– Safety net programs would save 24 cents for every additional dollar in wages paid to workers affected by a minimum-wage increase to $10.10.

The research in this issue brief is part of a forthcoming report that examines the relationship between raising wages for low-wage workers and reliance on public assistance programs in greater detail.

More From Economic Policy Institute: