Facing High Taxes, New Jersey Residents Want to Leave

< < Go Back

Deciding where to move? The NCPA’s state tax calculator can help you decide the tax consequences of your move over a lifetime. For example, a single, 40-year-old living in New Jersey with annual earnings of $100,000 could gain over $111,000 over the course of a lifetime if he moved to Texas, all based on taxes.

In fact, most New Jersey residents seem to realize that their state is not the best financial environment, writes Steve Malanga, senior fellow at the Manhattan Institute. He cites a recent poll from Monmouth University:

– Half of New Jersey residents want to leave New Jersey; 45 percent want to stay.

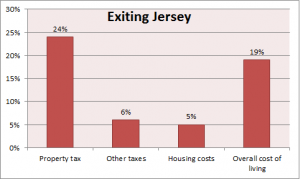

– Thirty percent of the residents who want to leave the state blame it on high taxes.

– Twelve percent of those who want to leave say there’s not enough economic opportunity.

The poll’s director pointed to the state’s high cost of living as the main factor that residents want to leave, noting that New Jersey has an especially high property tax, and its income tax is the seventh highest in the United States.

Malanga notes that New Jersey is not the only state with a high level of “outmigration” — Illinois and New York round out the top three. What’s significant about those three states? According to Malanga, they each have high levels of unionization in the public sector. The public sector unionization rate in New York is 69.9 percent, while it’s 60.7 percent in New Jersey and 52.3 percent in Illinois. And the national average? Just 35.3 percent.

New Jersey has struggled to fund its pension system, and state lawmakers recently suggested $1.6 billion in new taxes to help pay for the state’s public pensions.

More From NCPA: