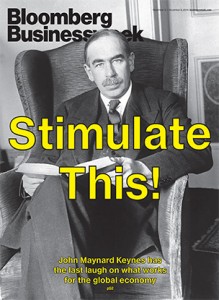

John Maynard Keynes Is the Economist the World Needs Now

< < Go Back

by Peter Coy,

Is there a doctor in the house? The global economy is failing to thrive, and its caretakers are fumbling. Greece took its medicine as instructed and was rewarded with an unemployment rate of 26 percent. Portugal obeyed the budget rules; its citizens are looking for jobs in Angola and Mozambique because there are so few at home. Germans are feeling anemic despite their massive trade surplus. In the U.S., the income of a median household adjusted for inflation is 3 percent lower than at the worst point of the 2007-09 recession, according to Sentier Research.

There is a doctor in the house, and his prescriptions are more relevant than ever. True, he’s been dead since 1946. But even in the past tense, the British economist, investor, and civil servant John Maynard Keynes has more to teach us about how to save the global economy than an army of modern Ph.D.s equipped with models of dynamic stochastic general equilibrium. The symptoms of the Great Depression that he correctly diagnosed are back, though fortunately on a smaller scale: chronic unemployment, deflation, currency wars, and beggar-thy-neighbor economic policies.

An essential and enduring insight of Keynes is that what works for a single family in hard times will not work for the global economy. One family whose breadwinner loses a job can and should cut back on spending to make ends meet. But everyone can’t do it at once when there’s generalized weakness because one person’s spending is another’s income. The more people cut back spending to increase their savings, the more the people they used to pay are forced to cut back their own spending, and so on in a downward spiral known as the Paradox of Thrift. Income shrinks so fast that savings fall instead of rise. The result: mass unemployment.

Keynes said that when companies don’t want to invest and consumers don’t want to spend, government must break the dangerous cycle by stepping up its own spending or cutting taxes, either of which will put more money in people’s pockets. That is not, contrary to some of his critics, a recipe for ever-expanding government.

Enthusiasm for Keynes waxes and wanes. The last time the gawky Brit made a splash was 2008-09, during the global financial crisis. People who had borrowed extravagantly, using their houses as ATMs, turned overnight into financial Calvinists, cutting spending to pay down debt. Nervous chief executive officers simultaneously cut back on corporate investing. “When things collapse, everybody becomes a Keynesian,” says Peter Temin.

“The only way to prevent a deepening recession will be a temporary program of increased government spending.” The following February, Congress passed a $787 billion stimulus, albeit smaller than Keynesian economists advocated and with no Republican votes in the House. Even Germany, that bastion of austerity, put aside its misgivings and approved its biggest stimulus package ever.

The Keynesian jolt didn’t last long. European governments pivoted to austerity on the theory that doing so would reassure investors and induce a wave of investment, creating growth and jobs. It didn’t happen. The U.S. was marginally less austere and grew a bit faster. But even in the U.S., stimulus faded quickly despite continuing high unemployment. Far from priming the pump, changes in government outlays actually subtracted from the growth of the U.S. economy in 2011, 2012, and 2013.

With fiscal policy missing in action, the world’s biggest central banks tried heroically to plug the gap. The U.S. Federal Reserve cut interest rates to near zero, and when even that failed it tried some new tricks: buying bonds to bring down long-term interest rates (“quantitative easing”) and signaling the market that rates would stay low even after the economy was on the path to recovery (“forward guidance”). The limited effectiveness of those measures is sometimes chalked up as a failure of Keynesianism, but it’s just the opposite. Keynes was the economist who demonstrated that monetary policy ceases to be effective once interest rates hit zero and whose recommended policy in those circumstances was tax cuts and spending hikes.

Whatever the economic facts, the slowness of the global recovery soured people on governments’ ability to intervene for the good. Stimulus is a toxic word in the U.S. midterm elections; Obama got nowhere with his $302 billion bridges-and-potholes bill this year.

Enter Lord Keynes. Cutting interest rates is fine for raising growth in ordinary times, he said, because lower rates induce consumers to spend rather than save while stimulating businesses to invest. But where rates sink to the “lower bound” of zero, he showed, central banks become nearly powerless, while fiscal policy (taxes and spending) becomes highly effective as a fix for inadequate demand.

f instead governments of rich nations do nothing more, hoping their economies heal on their own, they’ll all risk getting stuck in the same rut that’s trapped Japan for most of the years since its postwar economic miracle abruptly ended in 1990.

In the 1950s and 1960s, Keynesian thinking ruled. President Kennedy’s chief economic adviser, Walter Heller, persuaded the president in 1963 to propose a tax cut to stimulate demand.

Keynes came under a cloud starting in the 1970s because his theories couldn’t readily account for stagflation—the coexistence of high unemployment and high inflation.

Supply-side economists said Keynes missed how low taxes could stimulate long-term growth by inducing work and investment.

A successor theory that evolved in the 1980s and 1990s, New Keynesianism, attempted to inject rational expectations theory into Keynes’s worldview while preserving his observation that prices and wages are “sticky”—i.e., they don’t fall enough in a slump to equalize supply and demand. New Keynesians range from conservatives such as John Taylor of the Hoover Institution to liberals like Berkeley’s DeLong.

If Keynes were alive today, he might be warning of a repeat of 1937, when policy mistakes turned a promising recovery into history’s worst double dip. This time, Europe is the danger zone.

Now as then, getting out of the doldrums will take concerted international action.

The big question is whether today’s international financial architecture is up to the challenge of restoring balance to global trade and investment.

So goes the fighting among the physicians as the patient ails. Keynes saw the same kind of flailing at the start of the Depression. “We have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand,” he wrote in 1930. “The result is that our possibilities of wealth may run to waste for a time—perhaps for a long time.” Keynes himself has shown us the way out.

More From Bloomberg Businessweek: