Job Growth Rebounds, but Wages Lag

< < Go Back

Unemployment Rate Falls Below 6% for First Time Since Recession, Fueling Hopes for Faster Recovery.

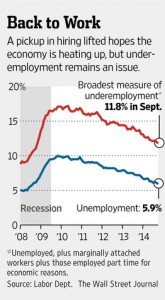

The nation’s unemployment rate slipped below 6% for the first time since the recession as hiring returned to a strong pace, lifting hopes for an economy that continues to show sluggish wage growth and persistent underemployment.

Employers added 248,000 jobs in September, rebounding from a weak August, the Labor Department said Friday. Payrolls have expanded an average 227,000 a month this year, putting 2014 on track to be the strongest year of job growth since the late 1990s.

September’s employment report released on Friday shows the jobless rate dipped to 5.9%. WSJ’s Justin Lahart and Sudeep Reddy join the News Hub for a full analysis of the data. Photo: Getty

The jobless rate fell two-tenths of a percentage point to 5.9%, the lowest level since July 2008, continuing a slide that partly reflects a shrunken labor force. Unemployment, nearly five years after surging to 10% in the wake of the recession, is moving closer to the 5.2%-5.5% range the Federal Reserve expects to see in the long run.

The upbeat report was tempered by weak earnings growth and continued high underemployment, reflecting workers stuck in part-time jobs.

But it still heightened prospects the Fed would move sooner than expected—perhaps in early 2015—to raise short-term interest rates.

Friday’s report offers the last major snapshot of the economy before November’s midterm elections, locking in a political dynamic in which a relatively slow jobs recovery has given little uplift to President Barack Obama and his party. Mr. Obama, in two speeches this week, seized on labor-market progress as evidence the economy is picking up on Democrats’ watch. Republicans have countered by pointing to flat incomes and a shrinking share of workers in the labor force.

Indeed, Friday’s report highlighted underlying ills that threaten the economy’s long-term potential to grow and lift Americans’ living standards.

The labor-force participation rate—reflecting the share of working-age Americans who have a job or are looking for one—fell last month to a three-decade low of 62.7%. Before the recession it stood at 66%. Only part of the decline is due to aging baby boomers; even among Americans in the prime working ages of 25 to 54, participation is historically low.

And workers’ wages still have yet to climb significantly. Among private-sector workers, average hourly earnings actually fell a penny last month, to $24.53. They have risen 2% over the past year. This is the second expansion in a row including the recovery after the 2001 recession, where economic growth hasn’t translated into rising incomes for most Americans.

While the economy is in the middle of a pickup, weak productivity growth and the downsized labor force point to limited gains in overall growth in the long term, said Morgan Stanley economist Ted Wieseman. “It’s just a dismal picture,” he said.

More From The Wall Street Journal (subscription required):