How to stop companies from deserting America before it’s too late

< < Go Back

by Allan Sloan,

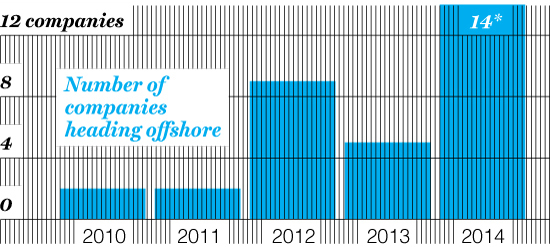

Sometimes even journalists get it right. My essay about companies incorporating overseas to dodge taxes, “Positively Un-American,” featured in our last issue, clearly struck a nerve. Since its publication, these corporate “inversions”—a euphemism for “desertions”—have taken on a life of their own.

Barely a day seems to pass without a corporation announcing that it plans to leave the U.S. to save taxes but wants to continue having its business, its employees, its directors, and especially its top executives benefit from our rule of law, democratic system, and the other great things that make America America. It just doesn’t want to pay its fair share for those things. This makes me angry. Judging from the reaction I’ve gotten from readers, it makes a lot of other people angry too.

What to do? In an ideal world I would slap serious penalties on inverters that do business with the federal government, and require them to underbid genuinely U.S. competitors in order to get federal business. Medtronic and Walgreen, that means you.

But we have to deal with what we have, not with what I would like to have. So what should we do? For starters, we shouldn’t make this political, because this is an American problem, not a Democratic or Republican problem.

Unfortunately, instead of using its influence quietly behind the scenes, the Obama administration has publicly entered the fray, via a July 15 letter from Treasury Secretary Jack Lew that invoked “economic patriotism” and urged Congress to do something about inversions. Pardon my skepticism, but the letter felt as if it was designed more to give President Obama populist talking points than to influence Congress to fix the problem.

Is there a solution? Glad you asked. The conventional wisdom is that we can’t solve the inversion problem without reforming the corporate income tax, which is a mess on multiple levels: a high rate, a million loopholes, mind-boggling complexity.

But I think the conventional wisdom is wrong. We have an emergency, folks, with inversions begetting inversions. As I was writing this column, another one hit: Drugmaker AbbVie announced it would buy Britain’s Shire for $54 billion. There’s a critical mass of hedge funds, corporate raiders, consultants, investment bankers, and others who benefit from inversions, and you can bet they’re all trying to make sure that nothing changes.

So I think we need to deal with the symptom—inversions—immediately. And with the cause—the tax system—later. The quick fix is legislation sponsored by Sen. Carl Levin (D-Mich.) and his brother, Rep. Sandy Levin (D-Mich.), that would stop inversions dead, at least for now. It would require companies that invert after May 8 of this year to do deals in which the foreign firm’s shareholders own at least 50% of the combined company (current threshold: 20%). In addition, managers of the inverting firm would have to step down. Opponents say that this is futile: Despite two previous fixes, we’re still awash in inversions, and stopping inversions will reduce any pressure to fix the tax system. There’s something to those arguments—but I still think we need to stop inversions cold right now to keep our tax base from eroding beyond repair.

We need more than just lower rates to solve our problem.

More From Fortune Magazine: