Growth Rebound Stokes Fed Debate

< < Go Back

Economy Bounces Back After Weak Start to Year, but Central Bank Signals Patience as Questions Linger.

Federal Reserve officials delivered a modestly more upbeat assessment of the economy Wednesday amid a second-quarter growth rebound and deepening debate inside the central bank about when to start raising interest rates.

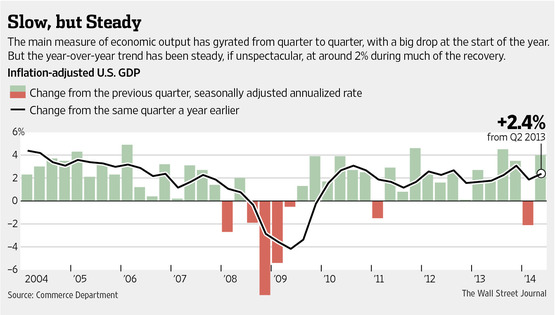

U.S. gross domestic product, a broad measure of the nation’s output of goods and services, advanced at a seasonally adjusted annual rate of 4.0% in the second quarter, the Commerce Department said Wednesday, a significant rebound from a wintry 2.1% contraction during the first three months of the year.

Overall, the economy appears to be neither as weak as was recorded in the first quarter nor as strong as the latest numbers suggest in the second. Compared with a year ago, economic output was up 2.4% last quarter, in line with the modest pace of growth that has characterized much of this recovery. The economy only grew at about a 1% pace for the first half of 2014.

“Economic activity rebounded in the second quarter,” the Fed said in a policy statement after a two-day meeting, the fourth such meeting under the leadership of Chairwoman Janet Yellen. “Labor market conditions improved, with the unemployment rate declining further.”

For Fed officials, who have argued for months that the first-quarter contraction was an anomaly, the numbers offered the confirmation they needed to continue scaling back a program of mortgage and Treasury bond purchases. That program, reduced to $25 billion per month from $35 billion, is meant to stimulate economic growth by holding down long-term interest rates. With output on the mend the Fed is winding the purchases down and intends to stop after October.

The Fed’s assessment of the economy included language subtly emphasizing that officials see the economy finally nearing their objectives after five years of disappointments. For months, Fed officials have said the jobless rate is elevated, but it dropped that reference after the rate hit 6.1% in June.

Officials also noted that inflation—which has been running below their 2% goal for two years—is getting closer to the objective and the risks of continued low inflation are diminishing.

Debate at the Fed is now turning to when to start raising interest rates. When last surveyed in June, most Fed officials said they expected to wait until 2015 and to move gradually once rate increases begin.

Ms. Yellen has indicated she wants to be patient, and the Fed’s policy statement Wednesday showed that remains her view. The Fed will wait a “considerable time” after bond purchases end before raising rates, the central bank said, reaffirming a position it has had since late 2012.

The Fed also noted that even though unemployment is down, “there remains significant underutilization of labor resources,” by which it means slack that will keep inflation and interest rates low.

More From The Wall Street Journal (subscription required):