States Target Corporate Cash Stashed Overseas

< < Go Back

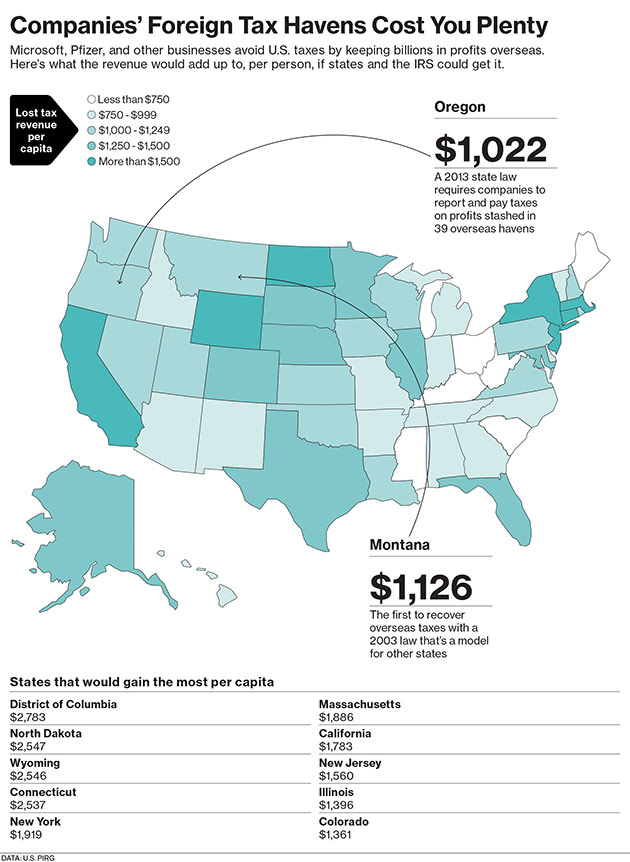

States want their share of $20B in lost tax revenue from companies that park profits in foreign tax havens.

Members of Congress have complained for years about U.S. corporations that park profits overseas to avoid paying federal taxes. Yet efforts to pass corporate tax reform that includes incentives and penalties to prod businesses into bringing that money home have stalled in Washington. Tired of waiting for a fix, several states are going after state tax dollars that disappear into offshore havens.

Oregon enacted a bill last June for the 2014 tax year identifying 39 countries and territories—including Barbados, Liberia, and the U.S. Virgin Islands—as corporate shelters. The state counts profits that corporations and their subsidiaries stash in shelter countries as taxable income, and companies that do business in the state must report it on their state tax returns and pay up. On April 16 the Democrat-controlled Maine legislature gave final approval to similar legislation, over objections from some Republicans that it’s anti-business. Minnesota and Rhode Island are studying whether to pursue bills of their own. “The issue at hand is one of fairness,” Maine Representative Adam Goode, a Democrat from Bangor, said during the debate on the bill he sponsored. “It really just seemed not in balance, not smart, and not fair that we would allow multinational corporations to hide their corporate income in a place like the Cayman Islands or in Bermuda.”

More From Bloomberg Businessweek: