Why Are The Poor, Poor?

< < Go Back

by John Goodman,

Have you ever wondered why poor people are poor? It’s not as though there aren’t plenty of role models around. Millions of people live highly successful, productive lives in this country. So why don’t people at the bottom of the income ladder copy the behavior of those several rungs above them and better their lot in life?

If this question doesn’t really interest you, that’s understandable. What’s not understandable is why it is not an interesting question for those who regard inequality of income the burning issue of the day.

For example, when is the last time you saw a Paul Krugman column on why poor people are poor? When Krugman writes about poverty, he can’t get more than a few sentences into the piece without launching into an attack on Republicans for being racists and indifferent to the plight of the poor. And that’s on a good day. When he’s in a bad mood, he depicts Republicans as actually delighting in the suffering of the poor. What motivates Krugman more: Concern for the poor? Or hatred of Republicans? You decide.

Okay. What about the rest of the paper? When is the last time you saw a New York Times unsigned editorial on why the poor are poor? How about any editorial in The New York Times?

Actually, there was one — just a few days ago. Under the heading “Where The GOP Gets It Right,” Nicholas Kristof writes that Republicans have been right all along — especially in stressing the role of strong families, job creation and education reform. (You wonder if Paul Krugman and Nicholas Kristof ever talk to each other.)

Yet good as it is, the Kristof column has one gaping hole: it totally neglects the role of incentives.

As I wrote previously, the federal government’s own pilot programs established conclusively from the very early days of the War on Poverty that the welfare state encourages people not to be married, not to work and not to invest in human capital.

This is Gene Steuerle before a House Ways and Means subcommittee:

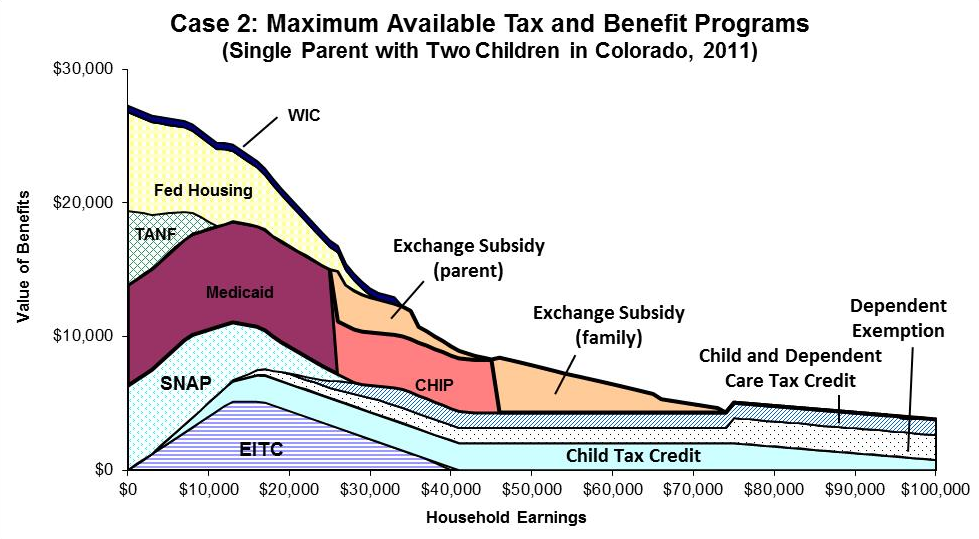

The chart below shows a hypothetical example whereby a family (single parent and two children) can receive nearly $30,000 in government benefits with no household earnings, but only about $10,000 in government benefits with $35,000 in household earnings.

So if the mother earns, say, $35,000 she loses about two-thirds of that amount in lost welfare benefits, and that’s not even counting what the government will take in income and payroll taxes.

Steuerle’s chart shows what incentives look like at a point in time. But activities today affect benefits tomorrow. For example, working and earning wages produces Social Security benefits and perhaps a private pension at the time of retirement. What do the incentives look like when we look at the lifetime effects of earning wages today?

That question was addressed in a study for the National Center for Policy Analysis by Jagadeesh Gokhale, Laurence J. Kotlikoff and Alexi Sluchynsky. They conclude that:

– Americans at every income level face a lifetime marginal net tax rate greater than 50 percent.

– That is, for every dollar they earn, they will lose more than 50 cents in higher taxes and reduced transfer benefits.

Moreover, single-parent households who qualify for more benefit programs than do couples face astonishingly high marginal tax rates beginning at lower incomes. For example:

At age 30, a single parent earning $10,000 a year faces a 72.3 percent marginal tax rate on an additional dollar earned due to their loss of welfare benefits; this rate is substantially higher than the 36.9 percent tax rate on the single parent earning $200,000.

More From NCPA: