Lower Your 2013 Tax Bill

< < Go Back

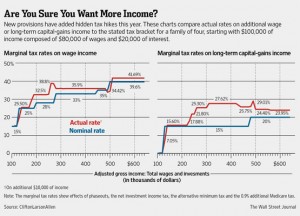

New hidden tax hikes will hit many people this year. Here’s how to lessen the blow.

You might think that tax planning would be easier this year. You could be wrong.

On New Year’s Day, Congress finally agreed to settle many unresolved issues, raising taxes for most Americans. But only one change was simple: the end of a two-percentage-point cut in Social Security taxes, which is costing wage earners up to $2,274.

Most of 2013’s other tax increases are less broad-based and more complicated.

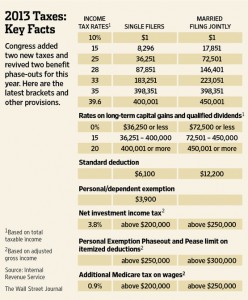

This year’s code includes two new taxes, a new top income-tax rate, a new top rate on long-term capital gains and dividends, a new inflation adjustment to the alternative minimum tax, or AMT, and two revived tax-benefit “phaseouts.” (See table on page B10.)

The upshot: For many people, it is more important than ever to estimate next April’s tax bill before year-end, while it might still be possible to make adjustments.

While the top 1% of taxpayers will bear much of the burden of this year’s increases, experts say, the code also has new tax traps for the affluent, roughly defined as people with an adjusted gross income, or AGI, between $150,000 and $500,000.

An example: This year a married couple with two children, typical deductions, $230,000 in wages and $20,000 in net investment income will be in the 28% income-tax bracket. But if they have an additional $10,000 of wages, Mr. Hesse says, their actual rate on it will be 38.8%—more than 10 percentage points higher.

“This hidden rate comes from the interaction between the AMT and the new 3.8% net investment income tax,” Mr. Hesse says. “Last year there was no 3.8% tax, so this anomaly wouldn’t have existed.”

This year’s taxes become even more complex if the taxpayer has “passive” income or losses from investments, or a sharp spike in investment income, perhaps from the sale of a large asset. The family mentioned above, for example, could owe nearly 13 percentage points more than the nominal 15% rate on long-term gains, Mr. Hesse says.

To find out how you could be affected, consult a tax professional, such as a certified public accountant or an IRS Enrolled Agent, or use an online tool.

More From The Wall Street Journal (subscription required):