Latin Migrants Shift Sights From U.S. to Neighbors

< < Go Back

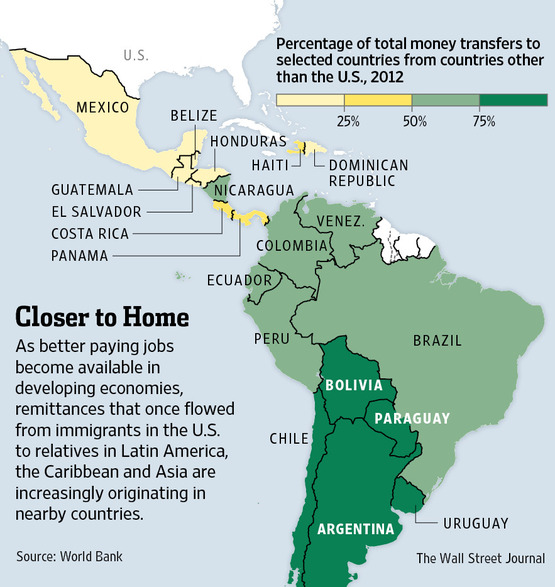

More Migrant Workers Send Money Home From Developing Countries.

It sounds like the typical American dream for an immigrant: Each month, Marco Antonio Serna sends $500 to his parents, wife and 17-year-old daughter back in Colombia. Except Mr. Serna, 43 years old, didn’t migrate to the U.S. for work; he went to Chile, where he is employed at a small casino outside Santiago.

“There’s a big community of Colombians here,” the former factory worker says.

In a noticeable and important shift in global migratory patterns, millions of migrant workers are no longer relying on the U.S. as heavily as they did for better-paying jobs that allowed them to send money home to families in Latin America, the Caribbean and Asia. Instead, they have moved more to developing economies, creating a shift in money transfers out of countries like Chile, Brazil and Malaysia.

According to Western Union, the world’s largest money-transfer firm, more than half of the company’s revenue 10 years ago was generated in the U.S. In 2012, that figure was less than 30%.

Most experts don’t expect the U.S. to lose its position as the world’s largest source of such money transfers or remittances. But the steady shift, which is allowing more immigrants to work closer to their home countries, is continuing despite some recent bumps in emerging-market economies.

“A long period of growth in emerging markets has created expanding opportunities in richer developing economies” that aren’t going away, said Harvard University professor Kenneth Rogoff, a former chief economist at the International Monetary Fund.

All told, migrant remittances world-wide topped $518 billion in 2012, according to the World Bank, almost 3% higher than the previous year.

Developing countries are even becoming magnets for workers from developed but faltering economies, such as Portugal and Spain. The European crisis triggered “an out-migration from previously migrant-receiving countries,” said Dilip Ratha, a World Bank economist who specializes in remittances.

“What we are seeing now is the beginning of a trend…that is going to accentuate going forward,”

Nearly 44% of immigrants to Chile have a university degree, according to the government. It is attracting Spaniards and Ecuadoreans who previously lived in Spain, in addition to Colombians, Dominicans and others who historically focused on the U.S.

Despite the shifting global money flows, countries such as the U.K., Germany and other large European nations are likely to continue to attract foreign labor, according to remittance experts. And the U.S. is still likely to remain dominant, too, in money transfers as Mexicans and Central Americans, in particular, continue to journey north over land to find work.

More From The Wall Street Journal (subscription required):