Combating Crowd-Out

< < Go Back

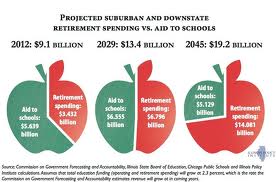

Much recent debate over the health of state and local budgets has been dominated by concerns about how spending on employee benefits is “crowding out” funds for basic services. The economy is growing, and spending is up — but taxpayers are seeing little benefit, says Stephen D. Eide, a senior fellow at the Manhattan Institute.

Much recent debate over the health of state and local budgets has been dominated by concerns about how spending on employee benefits is “crowding out” funds for basic services. The economy is growing, and spending is up — but taxpayers are seeing little benefit, says Stephen D. Eide, a senior fellow at the Manhattan Institute.

Crowd-out finds its roots in a problem of simple math. Cities can’t run deficits, so when growth in revenues fails to keep pace with any major spending category, some other category or categories must be reduced. The effect is most clearly discerned in local workforces, which are still down by over 500,000 employees since the recession, as well as salaries.

– Local government workers’ wages have been flat over the past decade, after adjusting for inflation, and salary spending has been taking up a smaller share of city budgets as benefits’ share has grown.

– Almost unintentionally, increases in benefit costs are reducing funds available to provide for salary increases for a workforce that is shrinking overall.

Crowd-out is felt in cities in blue states (Los Angeles) and red states (Houston) alike. In Baltimore, unchecked benefit spending threatens the city’s nascent renaissance. Some cities have resorted to adjustments that many would describe as gimmicks to respond to crowd-out, particularly the variety associated with pensions. But other, more authentic solutions are available.

– For instance, Boston’s record on managing health care crowd-out offers valuable lessons for other states and cities.

– Detroit illustrates the thin line between crowd-out and insolvency.

The best thing for cities to do to combat crowd-out is to keep government small.

More From NCPA: