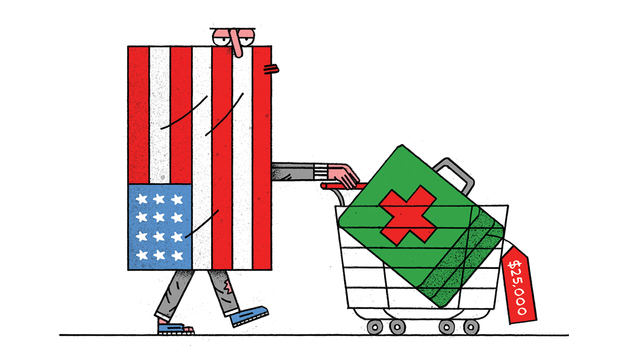

Insurance Exchanges Will Raise U.S. Health Care Costs

< < Go Back

Over time, rather than encourage insurance providers to offer ever more attractive and affordable policies, the exchanges are poised to push up the cost not only of insurance but also of health care itself. That means, if the history of U.S. health care policy is any guide, the exchanges’ very “success” will have the effect of limiting access to care for the 30 million people who are estimated to remain uninsured, says David Goldhill, author of “Catastrophic Care: How American Health Care Killed My Father — and How We Can Fix It.”

Over time, rather than encourage insurance providers to offer ever more attractive and affordable policies, the exchanges are poised to push up the cost not only of insurance but also of health care itself. That means, if the history of U.S. health care policy is any guide, the exchanges’ very “success” will have the effect of limiting access to care for the 30 million people who are estimated to remain uninsured, says David Goldhill, author of “Catastrophic Care: How American Health Care Killed My Father — and How We Can Fix It.”

Why are things set to go so badly? Because the architects of the health care exchanges have relied on three crucial assumptions, all of which are probably wrong.

First, they have assumed that if insurers are prevented from competing on benefit design or on underwriting, they will compete on price.

Second, the designers of the health care exchanges have also assumed that consumers, by shopping for the best deal, will drive down premiums.

Third, there’s the assumption that the price of health insurance passively mirrors the price of health care. In what may be the single greatest source of unintended consequences in the Affordable Care Act, insurers are now required to spend at least 80 percent of revenue from premiums on care.

In the end, we have incentives for insurers not to compete, for customers not to care about price, and for insurers to drive up the cost of care. Not much of a marketplace, is it?

More From NCPA: