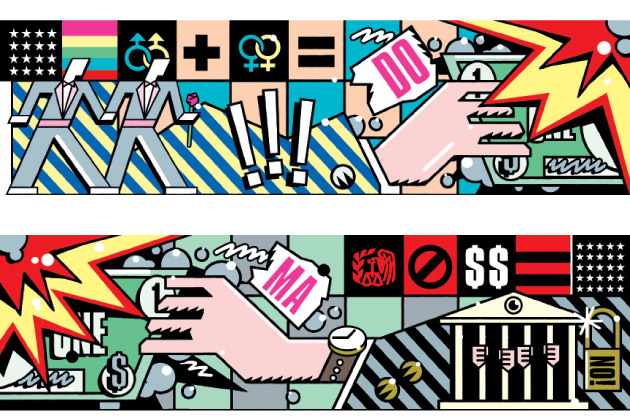

My Big Gay Tax Return

< < Go Back

by John Cloud,

In the weeks after the June 26 U.S. Supreme Court decision gutting the Defense of Marriage Act (DOMA)—the 1996 law that barred any federal recognition of same-sex relationships—gay Americans exulted in pride parades around the country, with placards, buttons, and even underwear declaring “Ding Dong DOMA’s Dead.” But the most consequential response to the ruling came from an unlikely source: the Internal Revenue Service. On Aug. 29, the IRS said spouses in legal gay marriages could refile tax returns as joint couples for up to three years after their weddings. For some, the change would potentially mean thousands of dollars in refunds.

In the weeks after the June 26 U.S. Supreme Court decision gutting the Defense of Marriage Act (DOMA)—the 1996 law that barred any federal recognition of same-sex relationships—gay Americans exulted in pride parades around the country, with placards, buttons, and even underwear declaring “Ding Dong DOMA’s Dead.” But the most consequential response to the ruling came from an unlikely source: the Internal Revenue Service. On Aug. 29, the IRS said spouses in legal gay marriages could refile tax returns as joint couples for up to three years after their weddings. For some, the change would potentially mean thousands of dollars in refunds.

Among the nation’s 313 million people, about 3.8 percent, or 11.9 million, identify themselves as gay or lesbian, according to the Williams Institute at the University of California at Los Angeles. Based on many years of social psychology research, it’s fair to say the true gay population is higher—perhaps double. Today gay couples can marry in 13 states and the District of Columbia. By the time Windsor’s case reached the Supreme Court, about 230,000 gay Americans had been legally married.

Demographers still aren’t clear on how the overall tax bills of gay Americans will be affected by the changes in the law, partly because the population of gay couples hasn’t been rigorously studied. Less affluent gays will likely benefit the most from the DOMA ruling; but if you and your same-sex spouse earn roughly the same, don’t rush to H&R Block.

And so gay couples slowly begin to see marriage with less exhilaration: It’s a romantic covenant, yes, but it’s also a financial deal that benefits from deliberation.

Which makes sense—we all hate the IRS equally. But what about all that sweat that got DOMA overturned? What about the hundreds of protests and petitions and rallies? If we are fighting merely for the right to avoid as many tax bills as straight people, should we be fighting so hard?

While I was employed by Time Warner, my husband wasn’t initially covered by the company’s health plan; after he was included, Ihad to pay for Christian’s insurance with after-tax dollars. This cost me $400 a month, or roughly $9,000 during the years I worked there after we were married.

While I was employed by Time Warner, my husband wasn’t initially covered by the company’s health plan; after he was included, Ihad to pay for Christian’s insurance with after-tax dollars. This cost me $400 a month, or roughly $9,000 during the years I worked there after we were married. While I was employed by Time Warner, my husband wasn’t initially covered by the company’s health plan; after he was included, Ihad to pay for Christian’s insurance with after-tax dollars. This cost me $400 a month, or roughly $9,000 during the years I worked there after we were married.

More From BusinessWeek: