Detroit Shows How Cities Can Shakedown ObamaCare

< < Go Back

Detroit’s bankruptcy came as no surprise to anyone who had watched for years as it (by turns) raided its retiree funds to pay its creditors and borrowed from its creditors to fund its retiree plans.

Detroit’s bankruptcy came as no surprise to anyone who had watched for years as it (by turns) raided its retiree funds to pay its creditors and borrowed from its creditors to fund its retiree plans.

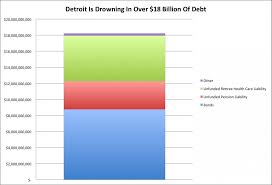

Its accumulated debt now approaches $20 billion, which is about 16 to 18 times its annual budget.

Detroit’s bankruptcy plan would give unsecured private lenders (who include creditors backed by general obligation bonds) only pennies on the dollar.

It’ll pay a considerably greater portion of the pension benefits of its 19,000-plus retirees. But their health care costs it plans to make Uncle Sam’s problem.

Detroit officials regard this as a “win-win” for Detroit and its retirees. But what they don’t say is that it’ll be “lose-lose” for the country and federal taxpayers.

The Pew Center for the States recently looked at 61 major cities across the country and found that, taken together, they had promised $118.2 billion in unfunded health care benefits. But that doesn’t even begin to scratch the surface.

– A 2006 study by Jagadeesh Gokhale and Chris Edwards of the Cato Institute estimated that the average unfunded health cost per government employee is $135,313.

– Given that about 10.3 million workers are covered by state and local government health care plans on retirement, that works out to $1.4 trillion.

Read More: