Debt Trap

< < Go Back

Debt Trap

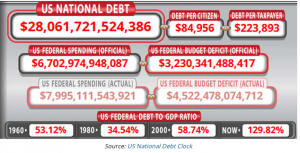

One of my favorite sites is also one of the most terrifying: US National Debt Clock. It has real-time, running tickers showing government debt and literally scores of other related statistics. Here’s a screen snap from earlier this week.

Last September in Great Reset Update, I estimated a $50 trillion federal debt by 2030.

This week I noticed the US Debt Clock has a 2025 projection page, which simply presumes everything continues at today’s rates for four more years. It puts the debt at $49.7 trillion in March 2025.

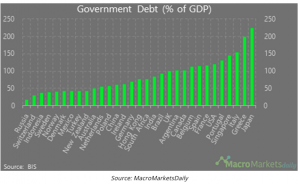

I am asked all the time how long this can go on. Is there an end in sight? The simple and honest answer is that we don’t know. The US dollar is the world’s reserve currency. Japan is a secondary reserve currency, as is the euro. Japan and many European countries, (and strangely, Singapore) are all running debt-to-GDP ratios higher than the US is today.

This is a massive poker game. The market knows the Fed has a strong hand, but doubts the Fed’s willingness to play it. The Federal Reserve hopes markets will fold. Maybe, if the stock market falls 20% (a real possibility if inflation reaches 3.5% and the 10-year yield exceeds 2% this summer). We don’t know yet how much effect the stimulus will have. Will recipients save most of it like they did last time? Will they put it in stocks? Will consumer spending and supply chain problems push prices higher?

The Fed is betting the market will tolerate higher inflation.

More From Maudlin Economics: