< < Go Back

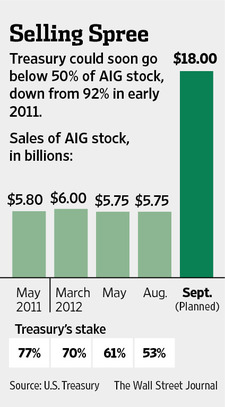

The Treasury Department said it would sell $18 billion of American International Group Inc. stock in a public offering, slashing its stake by more than half and making the government a minority shareholder for the first time since the financial crisis was roaring in September 2008.

The sale will mark a step that seemed hard to imagine four years ago, when the New York insurer was effectively nationalized as part of a controversial financial-industry bailout. The U.S. will move closer to recognizing a profit on its largest rescue, which included as much as $182 billion of committed aid, and AIG will revert to being mostly non-government-owned, fulfilling a priority of Chief Executive Robert Benmosche.

A near-exit by the government from one of the most controversial bailouts is both a significant accomplishment for the Obama administration and a sign of how far the markets have come in four years, thanks in part to the rescue of financial companies and the Fed’s efforts to support the economy by reducing interest rates.

But the sale could also renew complaints that Treasury still hasn’t outlined a concrete strategy for exiting other large financial-crisis investments, such as those in mortgage investors Fannie Mae and Freddie Mac FMCC -2.12% and lender Ally Financial Inc. The government remains in the red on its investments in Fannie and Freddie, which have received $188 billion in taxpayer support. The U.S. continues to hold sizable stakes in General Motors Co. GM -1.67% and Ally that it spent $68 billion on and may not fully recover.

In addition, the AIG sale could raise questions about timing, coming less than two months before a closely contested presidential election.

AIG stock today closed at $33.30. After this announcement after hours activity shows share price was dropping. Break even for the government was figured at $28.73.

Read More: WSJ