Does New Jersey’s Next Governor Want to Live in Connecticut?

< < Go Back

The Garden State should learn from Hartford’s bad example: You can’t tax your way to prosperity.

No matter what this year’s gubernatorial candidates may say, painless solutions to New Jersey’s fiscal challenges don’t exist. The state’s budget may be balanced on a “cash” basis, but a massive structural deficit lurks beneath. New Jersey’s property taxes, already the highest in the nation, are being driven up further by the state’s pension burden and escalating health-care costs for government workers.

Some politicians seem to think New Jersey can tax its way to budgetary stability. At a debate this week in Newark, the Democratic gubernatorial nominee, Phil Murphy, pledged to spend more on education and to “fully fund our pension obligations.” But he refused to say whether he would extend a soon-to-expire 2% cap on raises for firefighters and police, even though it is credited with keeping property taxes in check. Polls show Mr. Murphy is leading his Republican opponent, Lt. Gov. Kim Guadagno, by double digits. But just taxing more would risk making New Jersey’s fiscal woes even worse.

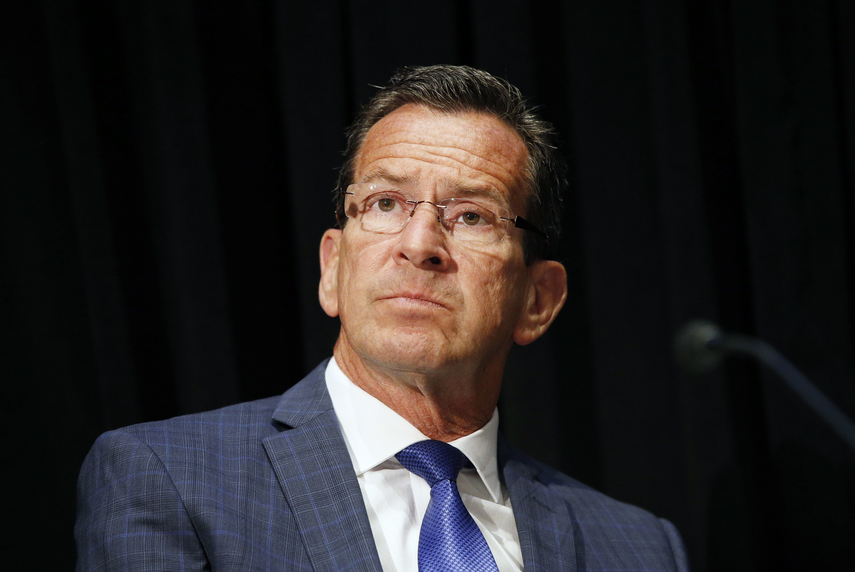

A useful comparison is Connecticut, which has tried to tax its way out of a similar set of problems. The two states have much in common: a relatively low poverty rate, high levels of personal income, a dependence on New York City, and unsustainable pension costs. The Pew Charitable Trusts ranks New Jersey and Connecticut as having among the worst-funded pensions in the nation.

More From The Wall Street Journal (subscription required):