A Fair Tax System

< < Go Back

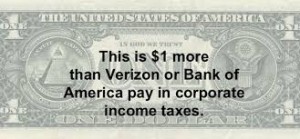

Corporations and the wealthy are failing to pay their fair share of taxes. As corporate profits are getting higher, corporate taxes are getting lower. Some huge corporations — like Boeing, General Electric and Verizon — have paid NO federal taxes in some recent years. The wealthiest Americans are dodging their fair share, too, with many paying a lower effective tax rate than many middle-class families.

The rest of us get stuck with the tab. Many of the services and benefits that families depend on — from Head Start and successful local schools to Social Security and Medicare — are facing cuts in funding, or in the earned benefits they provide. It has never been harder for working families to make it in America.

It’s up to us to change things. We can create a fairer tax system to ensure that corporations and the wealthy pay their fair share, and make it easier for families to regain the security they’ve lost.

We can do that by:

– Raising well over $1 trillion in new tax revenue from the wealthy and corporations over 10 years.

– Making corporations pay their fair share of taxes.

– Ending tax breaks that encourage corporations to ship profits and jobs overseas.

– Requiring the wealthy to pay their fair share of taxes.

More From Americans for Tax Fairness: