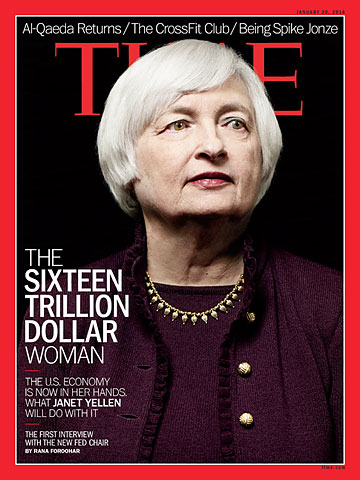

Janet Yellen: The Sixteen Trillion Dollar Woman

< < Go Back

By Rana Foroohar,

In her first and only interview as Fed chief, the economist says why she thinks the housing market is back on track, companies will invest, and more new jobs are on the way this year. She now has the world’s largest economy in her hands.

[A]s head of the San Francisco Federal Reserve Bank, Yellen would raise concerns about a fledgling bubble in subprime mortgages that would balloon into the worst economic disruption since the Great Depression–the first of the Fed’s 19 policymakers to do so. And in 2010, as the Fed’s vice chair, Yellen would find herself helping devise the latter stages of a controversial plan to buy trillions of dollars in assets, shoring up the battered economy. For millions of workers in the U.S. economy, that plan–the Fed’s so-called quantitative easing–may well have been the difference between losing a job and keeping it, between searching in vain and finding an opportunity.

[A]s head of the San Francisco Federal Reserve Bank, Yellen would raise concerns about a fledgling bubble in subprime mortgages that would balloon into the worst economic disruption since the Great Depression–the first of the Fed’s 19 policymakers to do so. And in 2010, as the Fed’s vice chair, Yellen would find herself helping devise the latter stages of a controversial plan to buy trillions of dollars in assets, shoring up the battered economy. For millions of workers in the U.S. economy, that plan–the Fed’s so-called quantitative easing–may well have been the difference between losing a job and keeping it, between searching in vain and finding an opportunity.

On Jan. 6, Janet Louise Yellen was confirmed by the Senate as the 15th chair of the Federal Reserve System of the United States. As Fed chair, she is responsible for deciding where and how money flows, not just in the U.S. but also in much of the world, given the dollar’s position as the global reserve currency. She is the first woman to hold the job. More important, she is also the first chair who is an openly reform-minded Keynesian–meaning she lives by the belief that monetary policy can temper the swings of the business cycle, strengthening the economy for workers as well as financiers. The diminutive 67-year-old Yellen smiles often and comes across as something like your favorite aunt.

In the coming months and years, she may need to work hard to keep her smile. Yellen, a 36-year veteran of the Fed, embarks on her new job at a precarious moment. Unemployment is receding, and the recovery is building, but the Fed must now unwind the unprecedented quantitative-easing program. Taper off the $75 billion-a-month purchase of Treasury bonds and mortgage-backed assets too quickly, and the recovery could stall. But wean the economy too slowly, and the risks of asset bubbles and longer-term inflation, which critics like eminent Fed historian Allan Meltzer believe are already a huge issue, could increase further–with consequences that nobody can really predict since there’s no road map for where we are now and no precedent for the policy decisions of the past few years.

The Fed, which turns 101 this year, is at little risk right now of compromising its dual mandate of keeping both unemployment and inflation low, a mandate that Yellen stresses she’s steadfastly committed to.

She’ll have to take on a few more as she struggles to oversee the implementation of several of the Dodd-Frank banking reforms and assesses whether the too-big-to-fail problem is finally behind us. Figuring out how to safety-proof the banking system is one of the challenges that pulled her back. “I think Dodd-Frank is a good road map and lays out most of the steps that are necessary. But we may also need to take some further steps that have not been taken yet,” she says. The Fed has, for example, been advocating higher capital requirements for the country’s largest banks, higher even than the new international standards that will likely be mandated by 2018.

“You know, a lot of people say this [asset buying] is just helping rich people. But it’s not true. Our policy is aimed at holding down long-term interest rates, which supports the recovery by encouraging spending,” she says. “And part of the [economic stimulus] comes through higher house and stock prices, which causes people with homes and stocks to spend more, which causes jobs to be created throughout the economy and income to go up throughout the economy.” Translation: a rising tide can lift all boats. That’s a phrase that’s been associated with conservatives in recent years, but it’s worth remembering that Kennedy said it first–and Yellen still believes it.

More From TIME Magazine: