Obamanomics, RIP

< < Go Back

An autopsy of an idea.

AN OLD SAYING sometimes attributed to Mark Twain goes: “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” And so it is with the current view that government spending stimulates the economy. It doesn’t. Government stimulus spending, paid for by running up the federal credit card, is why we have the never-ending Great Recession, though the left keeps fantasizing that spending “saved us from a second great depression.”

Now for the good news: The spending spree is over and Barack Obama is a lame duck. He is legislatively paralyzed. The signature achievement of his first term, the Patient Protection and Affordable Care Act, is under steady fire, and his job approval rating continues to slip. But the best evidence of his shrinking agenda is the trend in federal spending. It’s falling, and not at a trickle. Think Niagara.

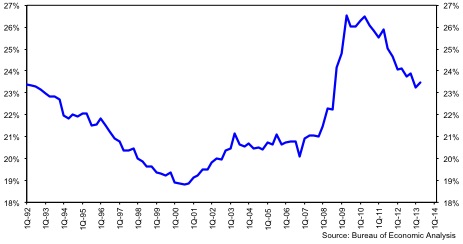

Washington is experiencing one of the biggest fiscal retrenchments in modern history, and almost no one is paying attention. In the wake of the Bush-Pelosi-Obama spending splurge from 2008-11, federal spending has fallen by 3.1 percentage points of GDP. In the second quarter of 2009, according to National Income Products Account data, federal spending hit 26.5 percent of GDP, thanks to the Obama stimulus and the Bush recession. As of the second quarter of 2013, just as the sequester was beginning to take effect, federal spending as a share of GDP is down to 23.5 percent and, barring some unforeseen emergency, is on track to fall to around 23 percent by the end of this year. The turning point in spending from the binge years of 2009 and 2010 came when the Republicans took control of the House in 2011.

More good news is that the annual deficit is falling too. The Great Recession, followed by stimulus, bailouts, Cash for Clunkers, unemployment insurance extensions, and other follies raised the deficit to $1.4 trillion in 2009, or just over 10 percent of GDP. By the end of this year, however, the deficit will be closer to $600 billion and 4 percent of GDP. In other words, federal deficits will be 2 percentage points less as a share of GDP than they were three years ago. And the decline may not stop even then.

For liberals who thought that Barack Obama’s second term would mean a 21st-century Great Society spending binge such as we saw from 2009 to 2011, this is a brutal reality. For Keynesians who believe that government spending cuts are “austerity,” this is also miserable news.

By contrast, we believe that this decline in government expenditures is a boon for the economy, and we have the evidence in hand to prove it.

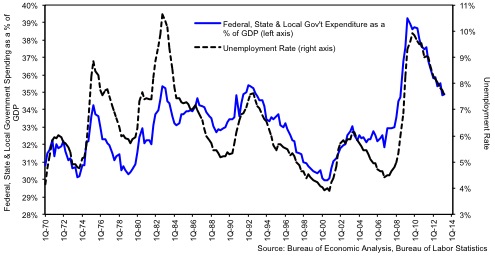

Many Americans who have sucked up the Keynesian vapors floating around in the ether cannot imagine that government spending actually hurts the economy. But we would love for the government-as-stimulus crowd to explain the chart below of government spending versus unemployment.  Correlations like this are vanishingly rare. The more the government spends as a share of GDP, the more Americans are out of work as a share of the labor force. Chico Marx’s famous line in Duck Soup puts the Keynesians into perspective: “Well, who you gonna believe, me or your own eyes?”

Correlations like this are vanishingly rare. The more the government spends as a share of GDP, the more Americans are out of work as a share of the labor force. Chico Marx’s famous line in Duck Soup puts the Keynesians into perspective: “Well, who you gonna believe, me or your own eyes?”

More From The American Spectator: