Connecticut, Nation’s Wealthiest State, May be Tapped Out on Taxing the Rich

< < Go Back

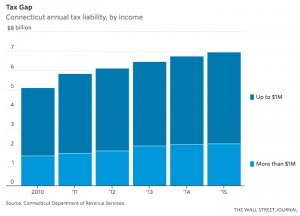

Connecticut’s budget office expects 2017 income-tax collections to fall for the first time since the recession.

The wealthiest state in the U.S. is having trouble collecting enough money to pay its bills, and the Democratic governor doesn’t think taxing the rich is the answer anymore.

After two decades of robust growth, Connecticut forecasts it will come in $400 million short in income-tax collections this fiscal year, worsening a budget crisis that has prompted all three major ratings firms recently to downgrade the state’s credit rating.

Connecticut’s budget office estimates that income-tax collections will fall in fiscal 2017 for the first time since the recession.

About $200 million of the drop in receipts came from the state’s closely watched top 100 earners, who are the source of an outsize proportion of the state’s revenue. Many of the state’s richest residents work for hedge funds, which have been hurt by a downturn in the industry.

Gov. Dannel Malloy has twice before bet that taxing the wealthy would help solve the state’s fiscal problems. But neither increase resulted in sustained revenue growth, according to his administration, which says it would be a mistake to do it a third time.

“You can’t go back to that well again,” said Kevin Sullivan, commissioner of Connecticut’s Department of Revenue Services. “The idea that there is yet another significant amount, in terms of long-term stability, to get out of that portion of the population is just not true.”

The tax question in Connecticut, where several thousand tax filers with adjusted gross incomes of more than $1 million a year account for about a third of all income tax receipts, comes amid a shift in tax policy nationally. President Donald Trump, who campaigned on promises to lower taxes, has proposed lowering business and individual rates. But he is also seeking to repeal a deduction on state taxes that will especially hit high-income earners, making it tougher for states to raise taxes among the richest.

Connecticut’s fiscal troubles come as a majority of states face budget holes this cycle, according to a recent report issued by Standard & Poor’s. At least nine states are considering some form of tax increase, such as raising corporation taxes and sales taxes, according to the report.

Connecticut is one of seven states, including Pennsylvania, New Jersey and Illinois, that is vulnerable to fiscal stress “even as the broader economy shows signs of gathering momentum,” the report concluded.

It’s a strange turn for Connecticut, which has the highest per capita income in the country, according to the Bureau of Economic Analysis, and is home to hundreds of hedge funds, Yale University, and businesses like insurer Aetna Inc. and industrial giant United Technologies Inc.

Connecticut introduced its income tax in the early 1990s, and income-tax growth averaged 9% a year from 1993 through 2008. Since then, the average has been 2% a year. Gov. Malloy put through two tax income increases, in 2011 and 2015, raising the top rate to 6.99%.

Opponents of the past tax hikes have said yet another one would scare away the very people the state relies on.

More From The Wall Street Journal (subscription required):