Venezuela’s Inflation Is Set to Top 1,600% Next Year

< < Go Back

Food shortages, weak oil prices and economic mismanagement has forced the government to declare a state of emergency.

While most advanced economies struggle to lift inflation, none would want Venezuela‘s situation: Consumer-price inflation is forecast to hit 480% this year and top 1,640% in 2017, according to the International Monetary Fund.

A shortage of medical supplies means infants and other sick patients are dying of treatable illnesses. Soldiers guard empty grocery store shelves. Inflation is so bad, the government has had to order bolivars by the planeload.

As Caracas extends its declared state of economic emergency, it’s no wonder many economists say the nation will soon have to ask the IMF for a bailout. It’s gotten so bad, the government this month handed over control of food stocks to the military, ceding even more power to the armed forces.

But Venezuela, whose government severed ties with the IMF nearly a decade ago under its former socialist autocratic leader, Hugo Chávez, hasn’t tried to restore relations with the world’s emergency lender.

“There has been no change in Venezuela’s relationship with the fund,” IMF spokesman Gerry Rice said Thursday. While the IMF has urged Caracas to reestablish a relationship, “the Venezuelan authorities have not contacted us,” he said.

China, seeking to take advantage of poor political relations that many African and Latin American nations have with the U.S. and Western-based institutions like the IMF, has been giving Venezuela and other commodity exporters cheap loans to help tide them through the commodity slump. Last year, the country supposedly secured $10 billion in cheap credit to help keep it afloat.

While those loans may keep the state budget limping along, including massive costly subsidy programs, and strengthen political ties to Beijing, they don’t require the deep policy overhauls many economists say are vital to repairing the broken economy.

Even if Venezuela had reached out to the fund, given that it has been years since Caracas has allowed the IMF to peer into its finances, Mr. Rice said “it would be difficult to give advice without substantive discussions.”

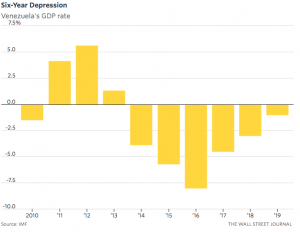

Here’s the IMF’s rough assessment of the country’s economy.

“Political uncertainty and as the renewed decline in the price of oil has deepened existing macroeconomic imbalances and pressures.” –IMF World Economic Outlook April 2016

More From The Wall Street Journal (subscription required):