Lib Lies About Obamacare

Lie #1. Obamacare covers everyone! Finally America is Fair!

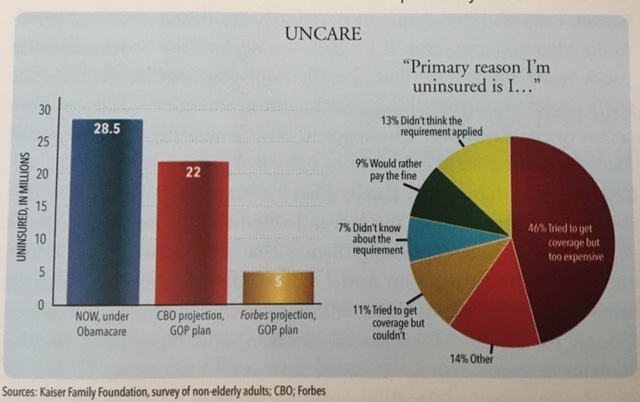

Lie #2. Repealing Obamacare will leave 22 million Americans uninsured!

Lie #3. "Obamacare has created 130,000 jobs...with even larger effect on employment overall."

Lie #4. Repealing Obamacare means 28,000 Americans every single year could die! That is none times more than ... on 9/11, every single year! Bernie Sanders

Lie #5. Obamacare is bending the cost curve downward! "Health care costs have risen at the slowest rate in 50 years!" Nancy Pelosi

More From Limbaugh Letter: