By Greg Ip,

from The Wall Street Journal,

6/28/17:

By singling out Medicaid, plan would signal burden of cost containment will fall largely on the poor.

The health-care overhaul that Senate leaders floated this past week does more than roll back an entitlement Republicans have loathed since the day it was enacted in 2010. It portends a deeper struggle over the safety net that pits the elderly against the poor.

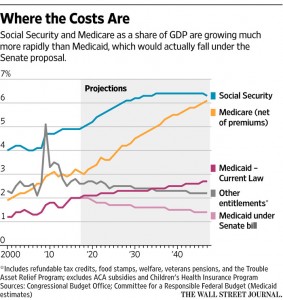

The federal government is often called an insurance company with an army. Thanks to aging and health-care inflation, the cost of that insurance is rising relentlessly. Social Security, Medicare and Medicaid now swallow 58% of tax revenue, and are on track to take 80% by 2047.

Heading off this fiscal collision is a task no politician relishes because of the ugly trade-offs required: whose taxes should rise? And if the answer is nobody’s, then whose benefits should be cut?

In that regard, the Senate Republican plan to replace the Affordable Care Act could be a watershed. Not only would it enact among the steepest cuts to a pillar of the safety net in decades; by singling out Medicaid, it would signal that the burden of cost containment will fall more on the poor than the elderly.

Of course, this isn’t the explicit intent of either the Senate draft or the slightly different ACA replacement passed by the House of Representatives last month. Neither deals with Medicare benefits.

That omission, however, speaks volumes. In 2012, Republican presidential candidate Mitt Romney and running mate Paul Ryan (now speaker of the House) proposed converting Medicare from fee-for-service to vouchers, and federal Medicaid to a block grant. The aim was to arrest the growth of both open-ended federal obligations.

Donald Trump later deduced those promises contributed to the ticket’s defeat, and so when he sought the Republican nomination, he promised not to touch Medicare or Social Security. Initially he also promised to spare Medicaid but that gradually receded from his pitch. When Mr. Trump’s first budget was unveiled last month, it pledged to curb safety-net programs including Medicaid and Social Security disability insurance but, at Mr. Trump’s insistence, not Medicare or Social Security pensions.

Still, while singling out the poor and walling off old-age entitlements may be politically shrewd, it is economically blinkered. Entitlements for the poor such as food stamps and tax credits are hardly out of control. Their cost as a share of gross domestic product fluctuates with the state of the economy, and after rising sharply after the last recession, is expected to return to its historical trend. Exceptions are disability benefits which have trended higher and Medicaid, which I will come back to.

By contrast Medicare’s costs are being pressured by both an aging population and the tendency of health costs to grow faster than general inflation. The Congressional Budget Office estimates federal Medicare spending will soar from 3.1% of GDP this year to 6.1% in 2047.

Roughly 8% of Medicaid’s 70 million beneficiaries are elderly and they receive 16% of benefits; the remainder are children, working-age adults and the disabled. So while aging does contribute to the program’s rising costs, the main factor is health-care inflation. The program’s costs are projected to rise from 2% of GDP this year to 2.7% in 2047.

The federal government funds about 60% of Medicaid by matching state spending. Republicans note this reduces the incentive to control costs, since a state shoulders only 40 cents of each dollar of spending. Both the House and Senate health bills would replace the matching formula with either a block or a per-enrollee grant. The financial impact, however, depends crucially on how the grant is determined.

Starting in 2025 the Senate would index per-enrollee payments to the overall inflation rate, a more stringent cap than either Mr. Romney or the House contemplated. If the cap held, federal Medicaid spending in 2047 would fall by nearly half relative to current law, to 1.4% of GDP, according to rough estimates by the CRFB.

Advocates argue this will encourage states to find more efficient ways to deliver health care, without hurting the poor. Those opportunities, however, are limited: administrative costs are negligible, and most states are funneling Medicaid patients into cost-conscious managed care plans. States will either have to replace the missing federal money themselves, or reduce benefits, restrict eligibility, cut fees to providers, or some combination thereof, widening the quality disparity between Medicaid and Medicare coverage.

Mr. Goldwein says while Medicaid is unsustainable, fixing it will not correct “our structural deficit until we deal with Social Security and Medicare.” Those two programs, he says, can be mended more gradually and thoughtfully by paring back benefits for middle class and upper income beneficiaries, which would in the process encourage more to keep working.

Economic reality favors, eventually, just such a fix. But not while today’s politics prevail.

More From The Wall Street Journal (subscription required):