The US Government spends more than it takes in just about every year. Here are the

budget deficit numbers by year since 1932. If anyone wants to know why we have a budget problem in this country, all you have to do is look at the

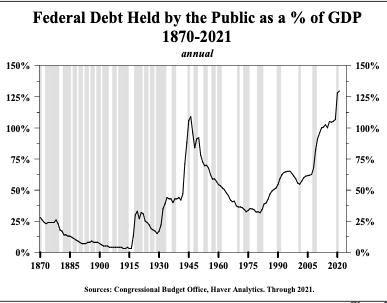

running debt clock. We are now at $21T in debt.! But, if big numbers alone don't get your attention, then lets put the $21T in perspective, it represents over 100% of GDP. The nation owed $10.6 trillion on Jan. 20, 2009, when President Obama was sworn in, and he doubled it – more than Bush piled up in two terms. There is bipartisan agreement that we cannot sustain this level of debt. There is also bipartisan agreement that we must correct the outflows exceeding inflows that drives the debt higher every second

(see debt clock) . Everyone who manages a checkbook has seen this problem before

and knows how to correct it - reduce expenses and increase income. Increasing revenues is critical to the solution, but will not have an immediate impact. Reducing expenses is also critical to the solution and can generate immediate impact. It is the only thing in your control instantly! Sequestration and government shutdown revealed that with immediate impacts in 2012 & 2013. Everything else we here about this subject beyond these two facts is just noise and should be ignored. The political

left and

right cannot agree on

how to correct this problem. The left solution to our problem is to increase taxes on the rich to increase income. Currently the top 20% of income earners pays 80% of the federal tax burden. So do we want them to pay 100%? 110%? 120%? Maybe just write the check every year for the entire cost of government, whatever it is? Clearly this is not a solution. The right wants us to reduce spending and taxes, which was also a poor solution in a recessionary economy, but in a growing economy in 2017 has promise. But, the truth is

we must do both (reduce expenses and increase income), we must do it now and it will not be easy. All the political hot air outside these two facts is simply a distraction from the difficult but obvious answer. Trump's tax law in Dec 2017 had an economic stimulation effect. A growing economy will usually increase income (tax revenues for the government) over the 10 years, but not immediately. The Trump tax reform due to money overseas that will be returning home, will have immediate positive revenue impacts. His military defense spending will have a negative national debt impact. To immediately begin to impact our budget deficit and debt problem whiling anticipating increased revenues

we also must immediately and dramatically cut spending. That MUST include discretionary spending AND entitlements (Social Security, Medicare & Obamacare) which represent 90% of the problem. The left will say you are hurting education, the homeless, healthcare of all Americans, the elderly and on and on. The right will shout "we are already taxed enough". All This whining MUST be ignored. No one wants to hurt themselves, their families or their neighbors We have no choice but to intelligently make these difficult decisions while minimizing the pain. But there will be pain. And our representatives MUST ACT NOW. It is a dereliction of duty if they do not. The 2 year budget passed Feb 2018 does not do this. It was a purely bi-partisan negotiation (which is good) but gives everything to everyone and makes no tough decisions on spending. Below you can watch the ongoing debate on this critical issue. And hopefully see the solution we need develop. Then, in 2020, the COVID-19 pandemic arrives and budget busting, debt and printing money takes on historic proportions!